Fundamental view:

The British pound traded downside against the US dollar having reached a lowest level of 3 months at 1.3201. The war is the major catalyst in dragging the sterling down. Leaders from all the West’s nations have asked President Vladimir Putin to put a halt to the war, but of no use. On Thursday, Putin said that he aims to reach its goals and will continue no matter what. while Putin agreed on the creation of safe corridors to evacuate civilians, he persisted in bombing Ukrainian cities. Headlines relating to the Russia-Ukraine war underpinned risk sentiment and in the absence of any top-tier economic releases from the UK, risk aversion wave ruled the market. Amidst the stagflation, soaring oil prices also undermined the cable.

Meanwhile, Fed Chair Jerome Powell maintained his hawkish stance in testimony at the semi-annual monetary policy report, confirming a 25 bps rate hike next week while showing the Fed’s openness for a series of rate hikes over the year. This underpinned the US bulls. Market will also remain wary of oil price action and any significant impact on the Bank of England’s (BOE) monetary policy expectations in the next week.

In this week, UK Nationwide HPI monthly report on 2nd March and US ISM Non-Manufacturing PMI on 3rd March boosted bullish trend whereas UK Markit/CIPS Services PMI on 3rd March and Fed Chair Powell Testimony on 2nd and 3rd March boosted bearish trend for the pair.

The major economic events deciding the movement of the pair in the next week are US JOLTS Job Openings, US EIA Crude Oil Stocks Change, US WASDE Report at Mar 09, US Initial Jobless Claims, Federal Budget Balance at Mar 10, UK Manufacturing Production monthly report, UK GDP monthly report and Michigan Consumer Sentiment at Mar 11.

GBP/USD Weekly outlook:

Technical View:

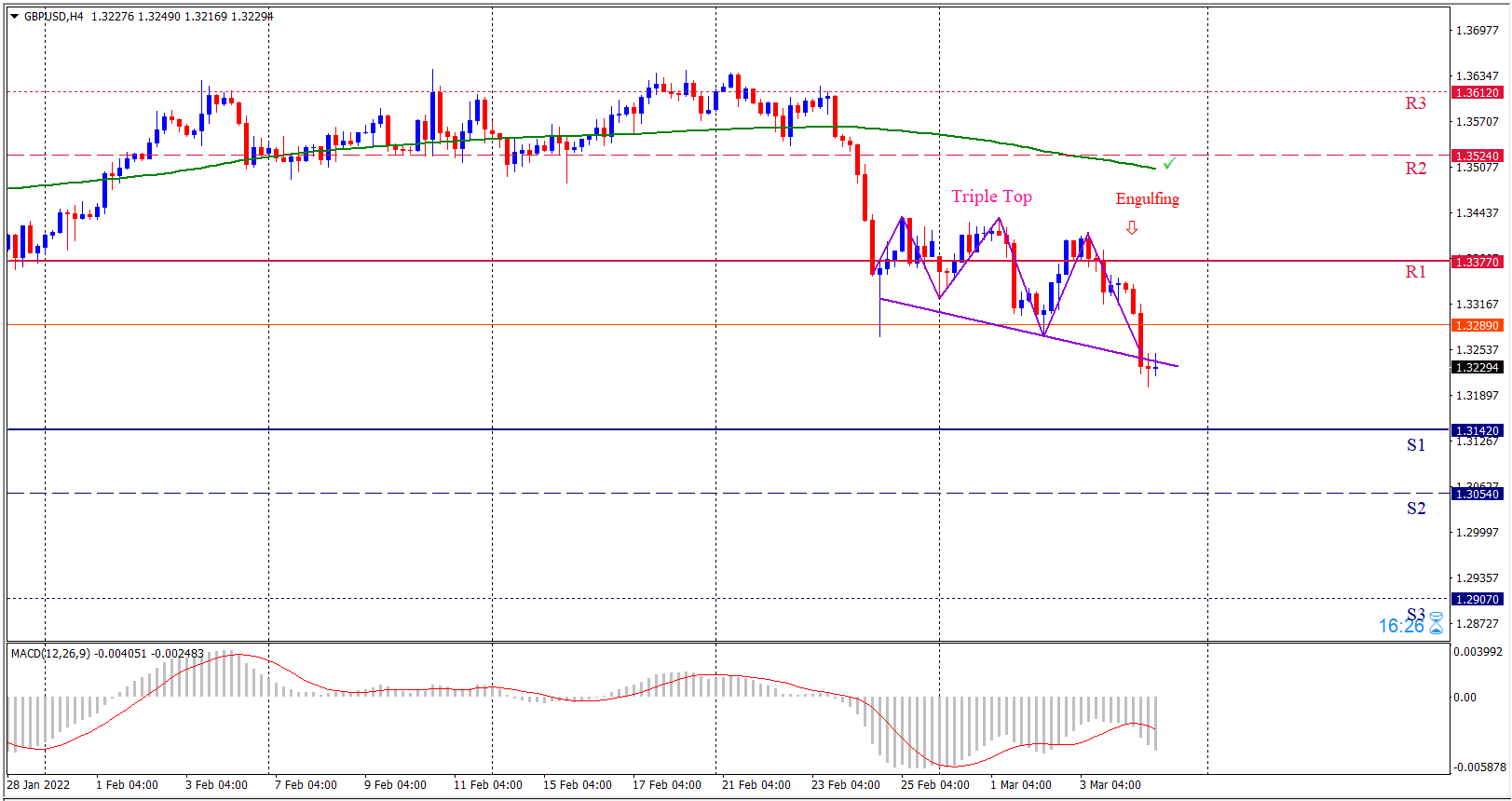

Last week’s high was 1.48% lower than the previous week. Maintaining high at 1.3437 and low at 1.3202 showed a movement of 235 pips.

In the upcoming week we expect GBP/USD to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. Should 1.3142 proves to be unreliable support then the pair may fall further to 1.3054 and 1.2907 respectively whereas a solid breakout above 1.3377 will open a clear path upward to 1.3524 and then will further raise up to 1.3612. Chart formation of triple top pattern in H4 chart favors prospects of a bearish trend. Bearish engulfing pattern formation escalates the expectation for a bearish trend.

| Preference |

| Sell: 1.3225 target at 1.3001 and stop loss at 1.3382 |

| Alternate Scenario |

| Buy: 1.3382 target at 1.3611 and stop loss at 1.3225 |