The Inverse Head and Shoulders Chart Pattern Trading Strategy is a price action trading strategy.

It is exactly the opposite of the head and shoulder chart pattern trading strategy.

This chart pattern is considered a bullish reversal chart pattern. That means if we see this chart pattern in a downtrend, then it may act as a signal that the downtrend is ending and therefore we should be looking to buy.

Timeframes : 5 minutes and above.

Instrument : Any

Indicators : None required.

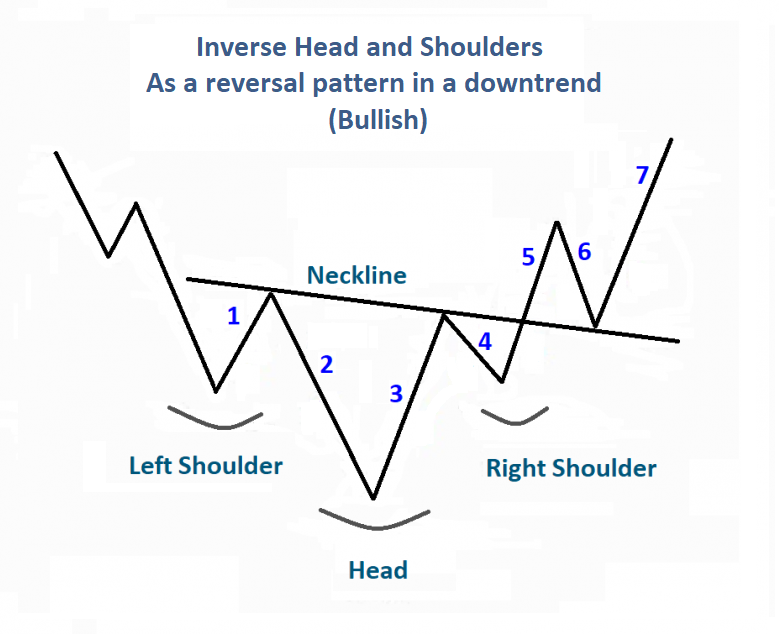

Here’s what an inverse head and shoulders pattern look like:

Forming of Inverse head and shoulders pattern:

Now let’s look at what each of the number from 1 to 7 on the head and shoulders pattern mean:

- Buyers come in at the low (which is the left shoulder) and push the price up (which results in a beginning neckline).

- Then next what happens is the sellers return to the market and push prices to new lows(which is the inverted head).

- But the new low is not sustained as price rises back up as buyers push price up to create a continuing neckline.

- Again sellers enter pushing the price down to a low, but this low does not exceed the previous low (the head). This low forms the right shoulder.

- Again Buyers get in and push the price up and now this time the neckline is intersected to the upside.

- Seller may get in here and push price down to test the neckline that was intersected which would now act as a support line.

- Buyers get in push the price up-now and an uptrend is in progress.

Trading Rules :

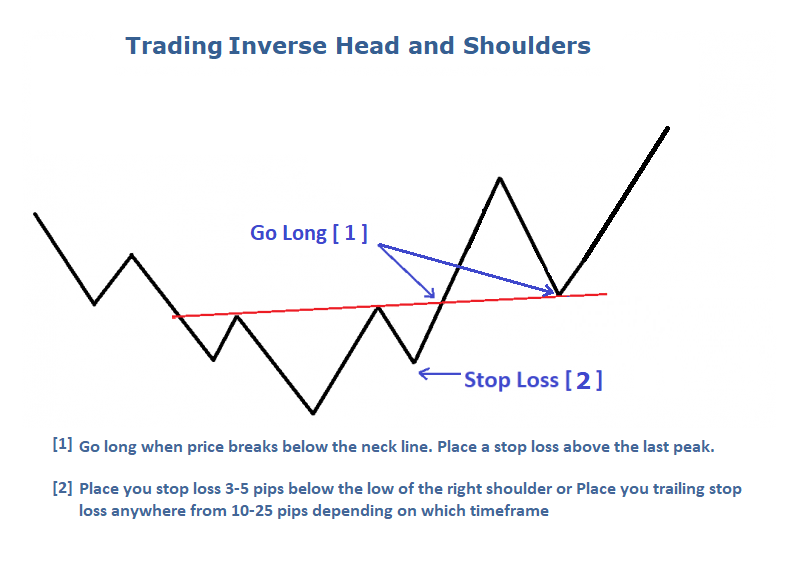

There are two options on how you can trade the inverse head and shoulders pattern:

1st Option:

- Wait until the candlestick breaks neckline to the upside.

- Now place a buy stop order just a few pips (at least 3 -5 pips) above the high of the candlestick intersects the neckline.

- Then place your stop 3-5 pips below the low of the right shoulder.

2nd Option:

- Wait until the price breaks the neckline; just wait for price to pull back down to touch the neckline which it intersected. This intersected neckline would now act as a support line.

- After it touches the neckline, place a buy stop order 3-5 pips above the high of the candlestick that touches the neckline.

- Then place you stop loss anywhere from 10-25 pips depending on which timeframe trading in just below were your buy stop order is placed.

- Try to use the bullish reversal candlestick patterns as your short entry confirmation on this option 2 entry style.

Let us explain with a chart below:

Take Profit :

There are 2 options for placing your take profit targets:

- Set Take profit at 1:2 times the amount you risked in pips.

- The other option would be to see a previous swing high point where price moved down from, and use that level as your take profit target.