The dollar sticks to gains on Monday as softening U.S. economic data and rising global coronavirus cases kept investors cautious, and lockdowns and Italian political turmoil held the euro under pressure.

A Better-than-expected Chinese economic data further headed towards selling, but it was not enough to shift currency traders’ mood. The mood soured after Friday data showed U.S. retail sales fell for a third straight month in December.

Elsewhere, Europe is facing surging cases of virus and an Italian government that must survive crucial votes in parliament on Monday and Tuesday in order to cling to power.

On the other hand, the US Centers for Disease Control and Prevention (CDC) reported that the total novel coronavirus cases of 23,653,919 as of yesterday versus 23,440,774 in the previous report on January 16. It should be noted that the vaccine producers are claiming to have the ability to tame the virus strains but can’t tame the market fears.

Apart from the virus updates and politics, cautious mood ahead of US President-elect Joe Biden’s first day of duty and initially negative signals for taxpayers and Canadian oil companies adds the risks.

Bank of Singapore currency analyst Moh Siong Sim said “The market is in a bit of a wait and see mode debating about the dollar, in terms of whether higher U.S. yields could provide support or whether we see further decline.”

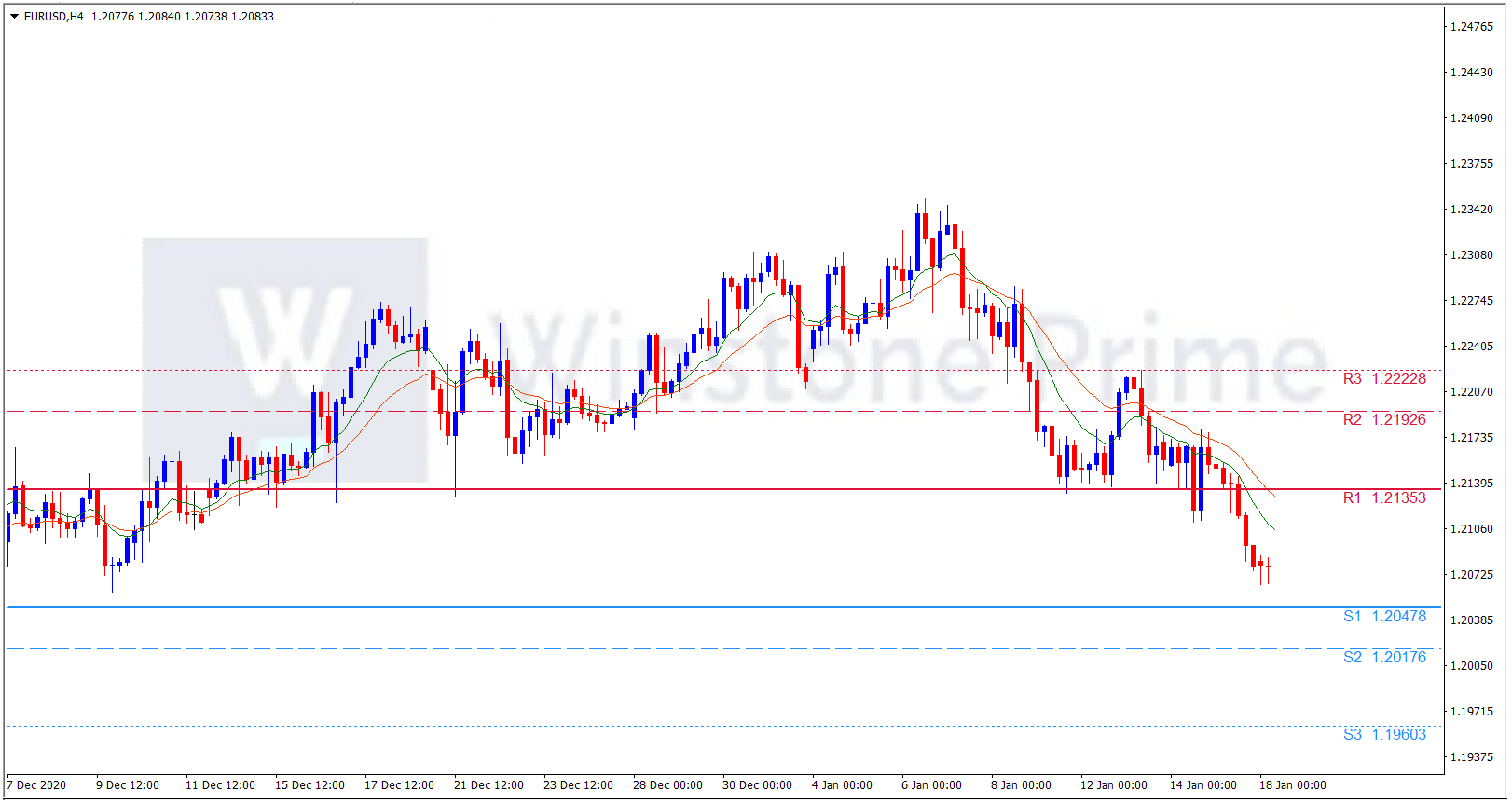

EUR/USD 4 Hour Chart:

Support: 1.2048 (S1), 1.2018 (S2), 1.1960 (S3).

Resistance: 1.2135 (R1), 1.2193 (R2), 1.2223 (R3).

In the prevailing market condition where dollar is under pressure against Euro, we expect a bearish trend for EUR/USD.