Fundamental view:

The US dollar has rallied significantly during the course of the week to reach towards 105 level. Demand for the greenback on risk-aversion boosted the pair, which held on to gains as Wall Street found they way up following a sell-off at the opening, trimming part of their intraday losses, although it fell to fresh lows with a dovish Fed. In the meantime, Japan published the final version of its November Leading Economic Index, which resulted in 96.4, below the expected 96.6. The Coincident Index for the same month resulted at 89, contracting from 89.4, these news also was a favor for the greenback.

US Chicago Fed National Activity Index on 25th January and US Durable Goods Orders on 27th January created downtrend movement of the pair whereas Japan BoJ Trimmed Mean Core CPI on 26th January and Japan Coincident Index & Leading Index on 27th January created uptrend movement of the pair.

The major economic events deciding the movement of the pair in the next week are BoJ Monetary Base yearly report, US ISM Manufacturing PMI at Feb 01, Japan Markit Services PMIUS ADP Nonfarm Employment Change, US ISM Non-Manufacturing PMI at Feb 03, US Initial Jobless Claims at Feb 04, and US Nonfarm Payrolls at Feb 05.

USD/JPY Weekly outlook:

Technical View:

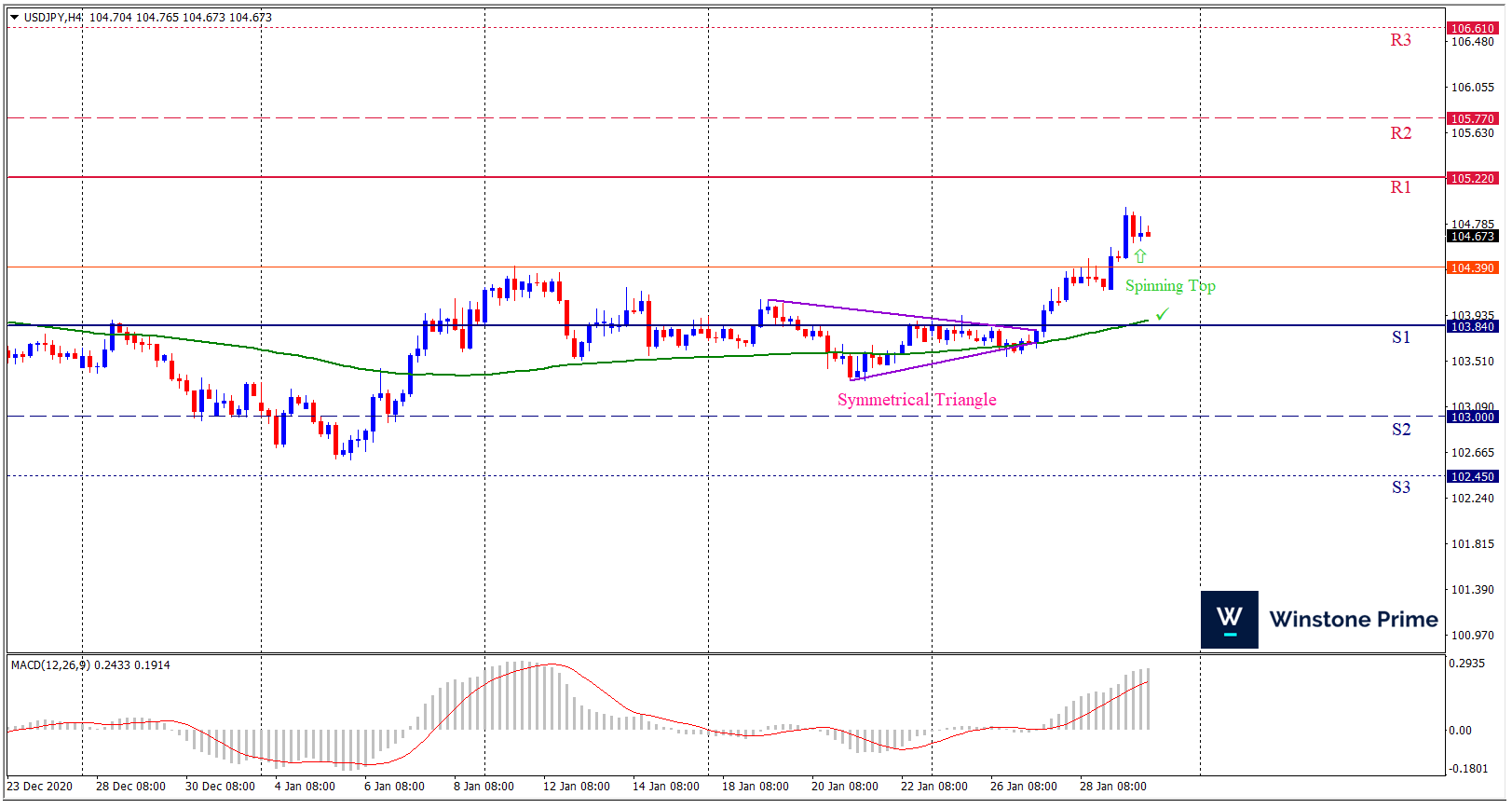

Last week’s high was 0.82% higher than the previous week. Maintaining high at 104.94 and low at 103.56 showed a movement of 139 pips.

In the upcoming week we expect USD/JPY to show a bullish trend. The currency pair is trading above the 100 Simple Moving Average and the MACD trades to the upside. A solid breakout above 105.22 may open a clean path towards 105.77 and may take a way up to 106.61. Should 103.84 prove to be unreliable support, the USDJPY may sink downwards 103.00 and 102.45 respectively. In H4 chart symmetrical triangle breakout favors prospects of a bullish trend Along with a bullish spinning top formation braces our expectation.

| Preference |

| Buy: 104.66 target at 105.67 and stop loss at 103.79 |

| Alternate Scenario |

| Sell: 103.79 target at 102.75 and stop loss at 104.66 |