Fundamental view:

The US dollar has rallied significantly against the Japanese yen during the course of the trading week. Surging US Treasury yields has helped the USD/JPY to reach a level of 112, the first time high since the pandemic. Federal Reserve Chair Jerome Powell has noted in his comments after the FOMC that a majority of members felt that the economic conditions for beginning a taper of the $120 billion in monthly bond purchases had been met. Treasury yields have been in sharp ascent since then. Another concern which has temporarily supported the safe-haven dollar was the fear that the US would default on its debt.

US S&P/CS HPI Composite-20 n.s.a. monthly report on 28th Sep and US EIA Natural Gas Storage Change on 30th Sep created bearish trend whereas Japan Coincident Index on 27th Sep and US Pending Home Sales monthly report on 29th Sep created bullish trend for the pair in this week.

The major economic events deciding the movement of the pair in the next week are OPEC Meeting at Oct 01, Markit Services PMI, US ISM Non-Manufacturing PMI at Oct 05, US ADP Nonfarm Employment Change, US EIA Crude Oil Stocks Change at Oct 06, US Initial Jobless Claims at Oct 07, Economy Watchers Index for Current Conditions and US Nonfarm Payrolls at Oct 08.

USD/JPY Weekly outlook:

Technical View:

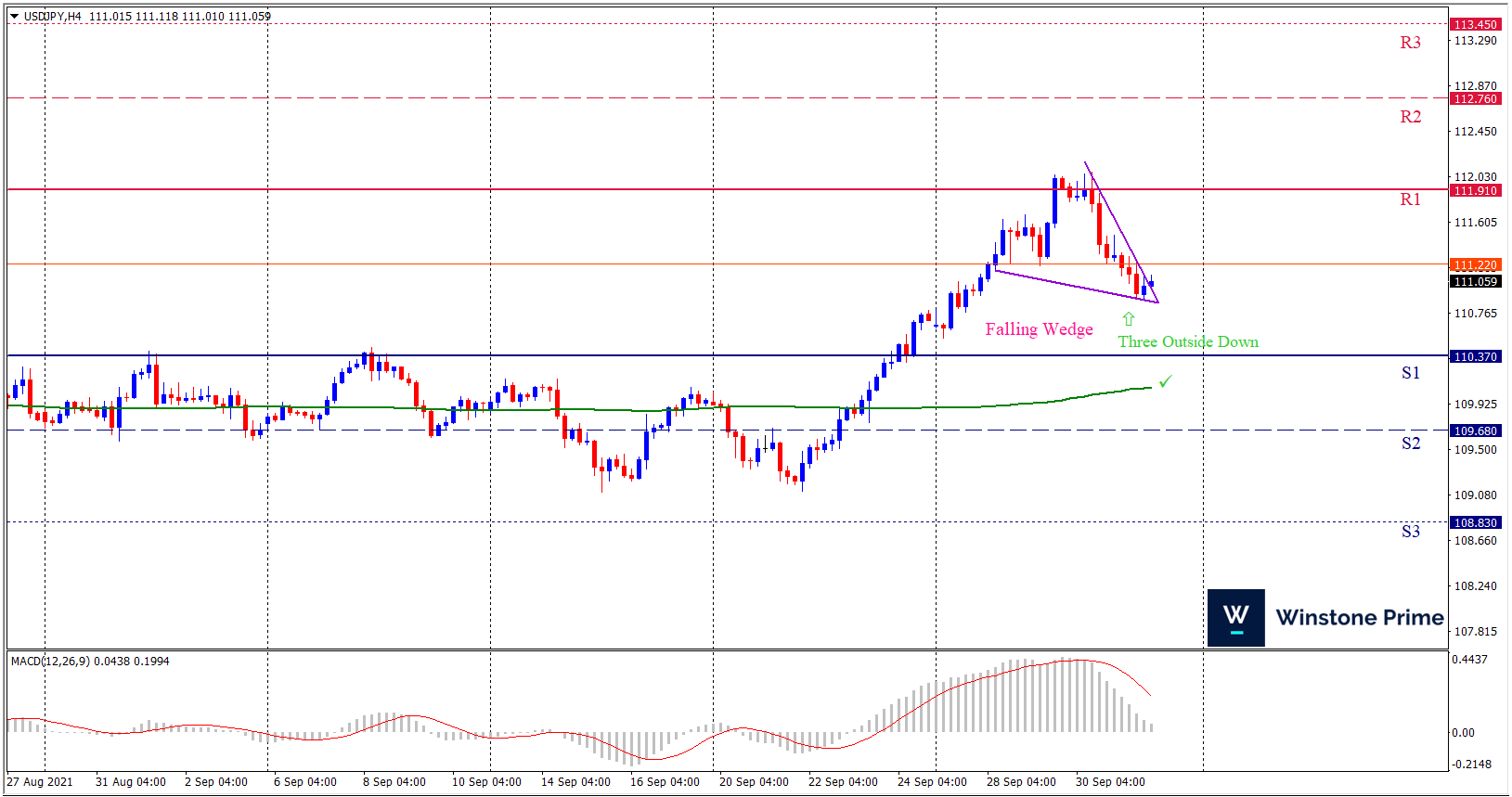

Last week’s high was 1.16% higher than the previous week. Maintaining high at 112.07 and low at 110.53 showed a movement of 154 pips.

In the upcoming week we expect USD/JPY to show a bullish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 111.91 may open a clean path towards 112.76 and may take a way up to 113.45. Should 110.37 prove to be unreliable support, the USDJPY may sink downwards 109.68 and 108.83 respectively. In H4 chart, Formation of falling wedge pattern indicates reversal of the trend raises prospects of a bullish trend And three outside down pattern formation further braces our expectation.

| Preference |

| Buy: 111.17 target at 112.69 and stop loss at 110.32 |

| Alternate Scenario |

| Sell: 110.32 target at 109.21 and stop loss at 111.17 |