Fundamental view:

US dollar managed to trade high against its yen counterpart. The stronger than expected inflation figure and the hawkish comments from the Fed policymakers helped the US dollar this week. The US reported the January Consumer Price Index, which soared to 7.5% YoY against the forecast of 7.2%,and the jump was the highest level since February 1982. Immediately after this data, the market rushed to price in a 50 bps rate hike from the US Federal Reserve as soon as March. Thus the US dollar gained attention from the traders, On the other hand, Japan’s government officially announced a three-week extension to the quasi-emergency for Tokyo and 12 other prefectures the previous day. This may be the reason which pushes the Bank of Japan (BOJ) policymakers to refrain from the hawkish messages and keep easy money on the table.

BoJ Corporate Goods Price Index monthly report on 10th February and US Michigan Consumer Sentiment on 11th February boosted downtrend whereas Japan Current Account n.s.a. on 8th February and US CPI monthly and yearly report on 10th February boosted uptrend for the pair.

The major economic events deciding the movement of the pair in the next week are Japan GDP quarterly report at Feb 14, Japan Industrial Production monthly report, NY Fed Empire State Manufacturing Index at Feb 15, US Retail Sales monthly report, EIA Crude Oil Stocks Change, FOMC Minutes at Feb 16, Initial Jobless Claims and US Philadelphia Fed Manufacturing Index at Feb 17.

USD/JPY Weekly outlook:

Technical View:

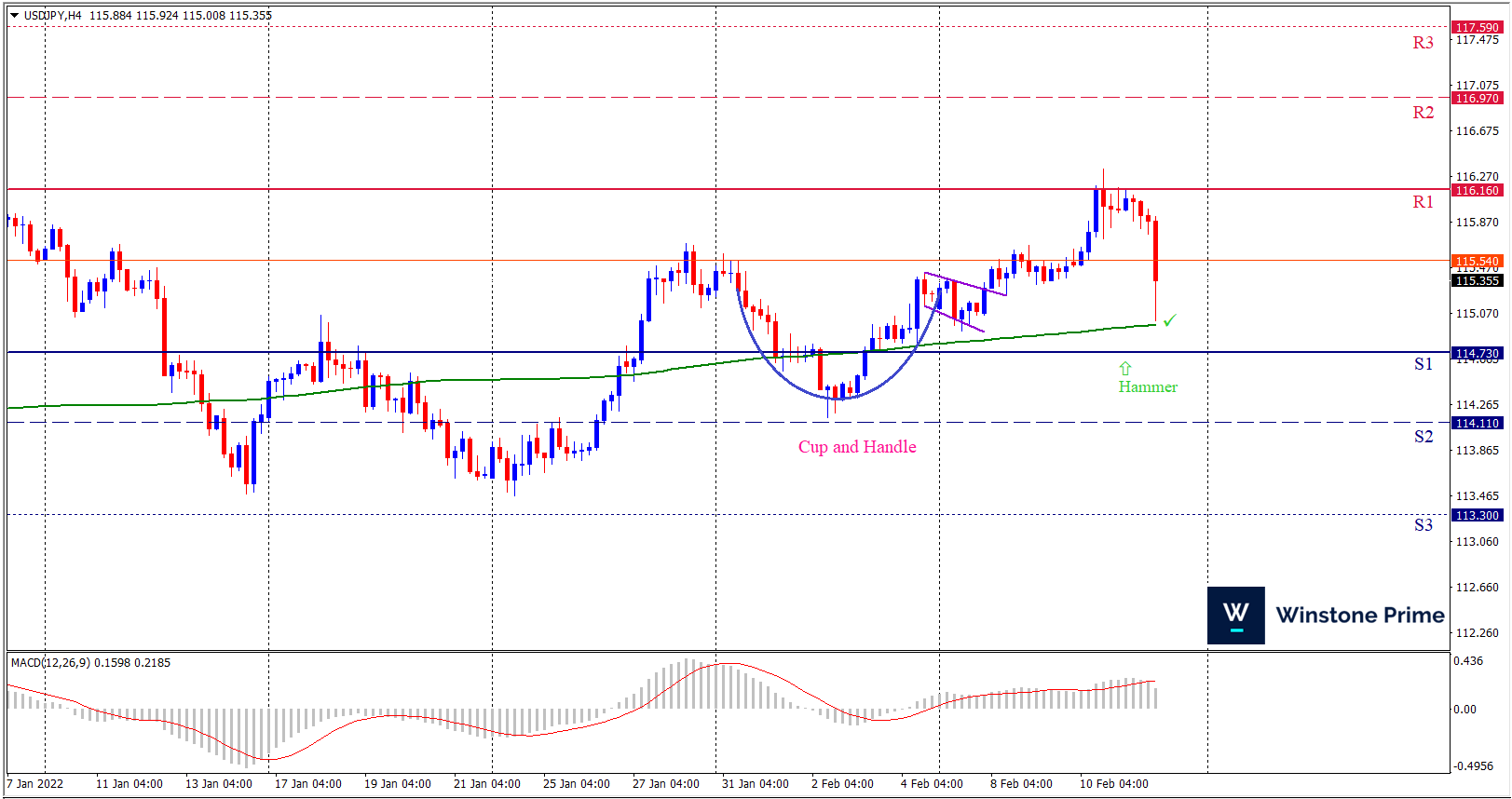

Last week’s high was 0.65% higher than the previous week. Maintaining high at 116.34 and low at 114.91 showed a movement of 143 pips.

In the upcoming week we expect USD/JPY to show a bullish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 116.16 may open a clean path towards 116.97 and may take a way up to 117.59. Should 114.73 prove to be unreliable support, the USDJPY may sink downwards 114.11 and 113.30 respectively. In H4 chart, Formation of cup and handle pattern indicates continuation of the trend creating prospects of a bullish trend Along with a hammer formation braces our expectation.

| Preference |

| Buy: 115.57 target at 116.96 and stop loss at 114.68 |

| Alternate Scenario |

| Sell: 114.68 target at 113.31 and stop loss at 115.57 |