Fundamental view:

The US dollar has fell against the Japanese yen to break well below the ¥105 level, but then turned around to recapture it. Movement in the pair is tied to improvement in the US economy and Treasury rates. There has also been a minor revival of inflation concerns even though there is no evidence of such and Federal Reserve Chairman Jerome Powell has discounted it. The repetitive size of the US budget deficits over the past five years and money creation by the government is a classic precursor to inflation.

Japan Economy Watchers Index for Future Conditions on 8th Feb and US Federal Budget Balance on 11th Feb created upside movement for the pair whereas Japan Overtime Pay yearly report & BoJ M2 Money Stock yearly report created downside movement for the pair.

The major economic events deciding the movement of the pair in the next week are Japan Industrial Production monthly report at Feb 15, Fed Governor Bowman Speech at Feb 16, Fed Industrial Production yearly report at Feb 17, Japan CPI yearly report, US Initial Jobless Claims, Philadelphia Fed Manufacturing Index at Feb 18, and FOMC Member Rosengren Speech at Feb 19.

USD/JPY Weekly outlook:

Technical View:

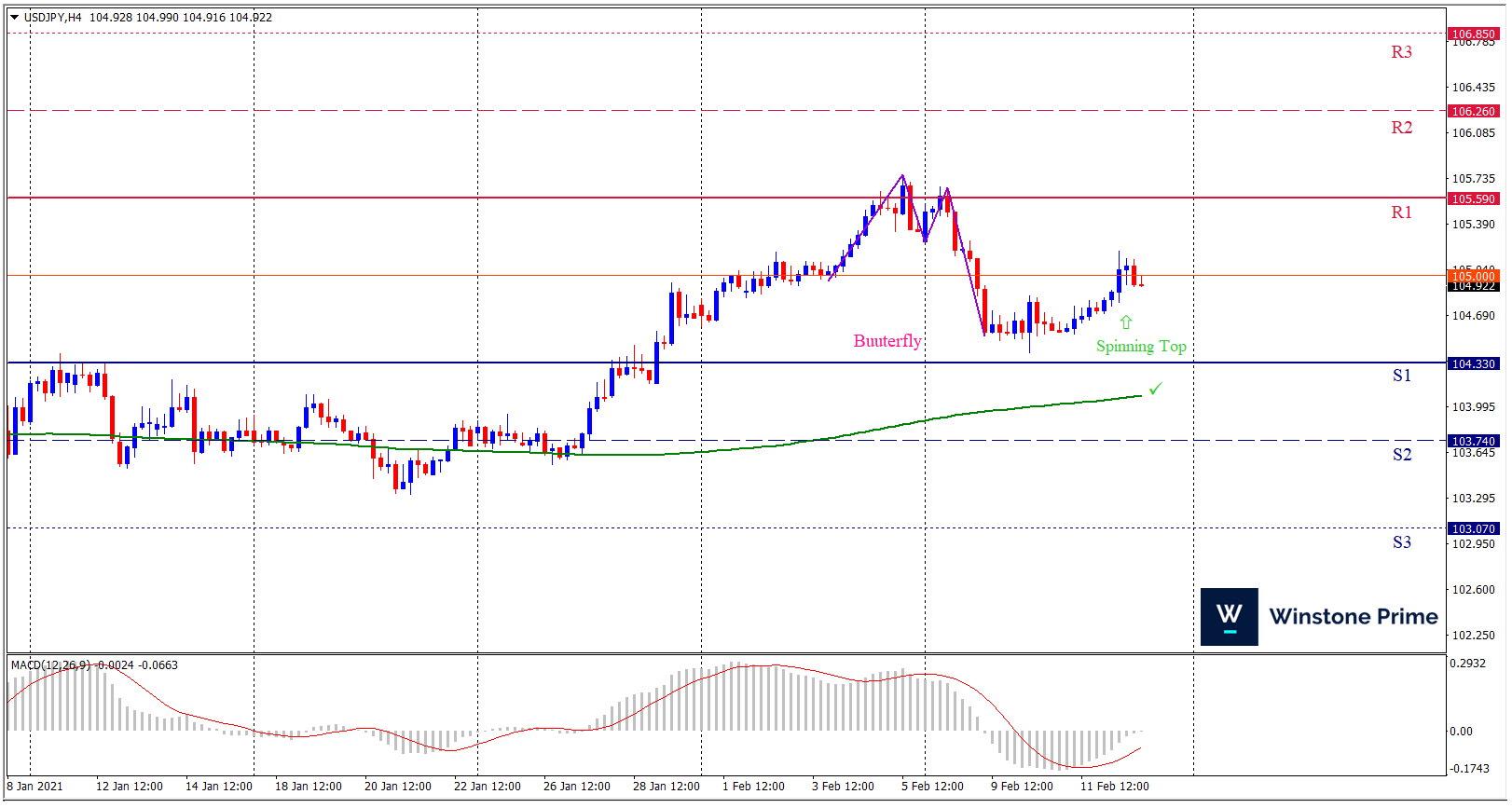

Last week’s high was 0.09% lower than the previous week. Maintaining high at 105.67 and low at 104.41 showed a movement of 126 pips.

In the upcoming week we expect USD/JPY to show a bullish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 105.59 may open a clean path towards 106.26 and may take a way up to 106.85. Should 104.33 prove to be unreliable support, the USDJPY may sink downwards 103.74 and 103.07 respectively. In H4 chart, Formation of bullish butterfly pattern indicates reversal of the trend creating prospects of a bullish trend Along with a bullish spinning top formation braces our expectation.

| Preference |

| Buy: 105.01 target at 106.25 and stop loss at 104.28 |

| Alternate Scenario |

| Sell: 104.28 target at 103.08 and stop loss at 105.01 |