Fundamental view:

The US dollar fell against many of its rival also against the Japanese yen during the trading course of the week. The fall of US dollar can be related to the US inflation. The Consumer Price Index was confirmed at 7% YoY in December, its highest since 1982. It is widely expected that the Federal Reserve policy makers are about to initiate a rate cycle at the March 16 meeting. With assuming the Fed meets forecasts with three 0.25% increases by December, the fed funds rate would only be 1% at the end of the year. For nearly seven years after the financial crisis of 2008-2009, the Fed kept the base rate at 0.25%, as it is now. On the other hand, In the upcoming week, the Bank of Japan meeting on Tuesday will produce no policy changes and if the bank reveals a new economic support package, it will have a little impact on the market.

In this week, Fed Chair Powell Testimony on 11th January and Japan Current Account n.s.a. on 12th January favored bullish trend whereas US CPI monthly report on 12th January and BoJ Corporate Goods Price Index yearly report on 14th January favored bearish trend for the pair.

The major economic events deciding the movement of the pair in the next week are BoJ Interest Rate Decision, US TIC Net Long-Term Transactions at Jan 18, US Building Permits at Jan 19, BoJ Monetary Policy Meeting Minutes, Initial Jobless Claims, EIA Crude Oil Stocks Change at Jan 20 and Baker Hughes US Oil Rig Count at Jan 21.

USD/JPY Weekly outlook:

Technical View:

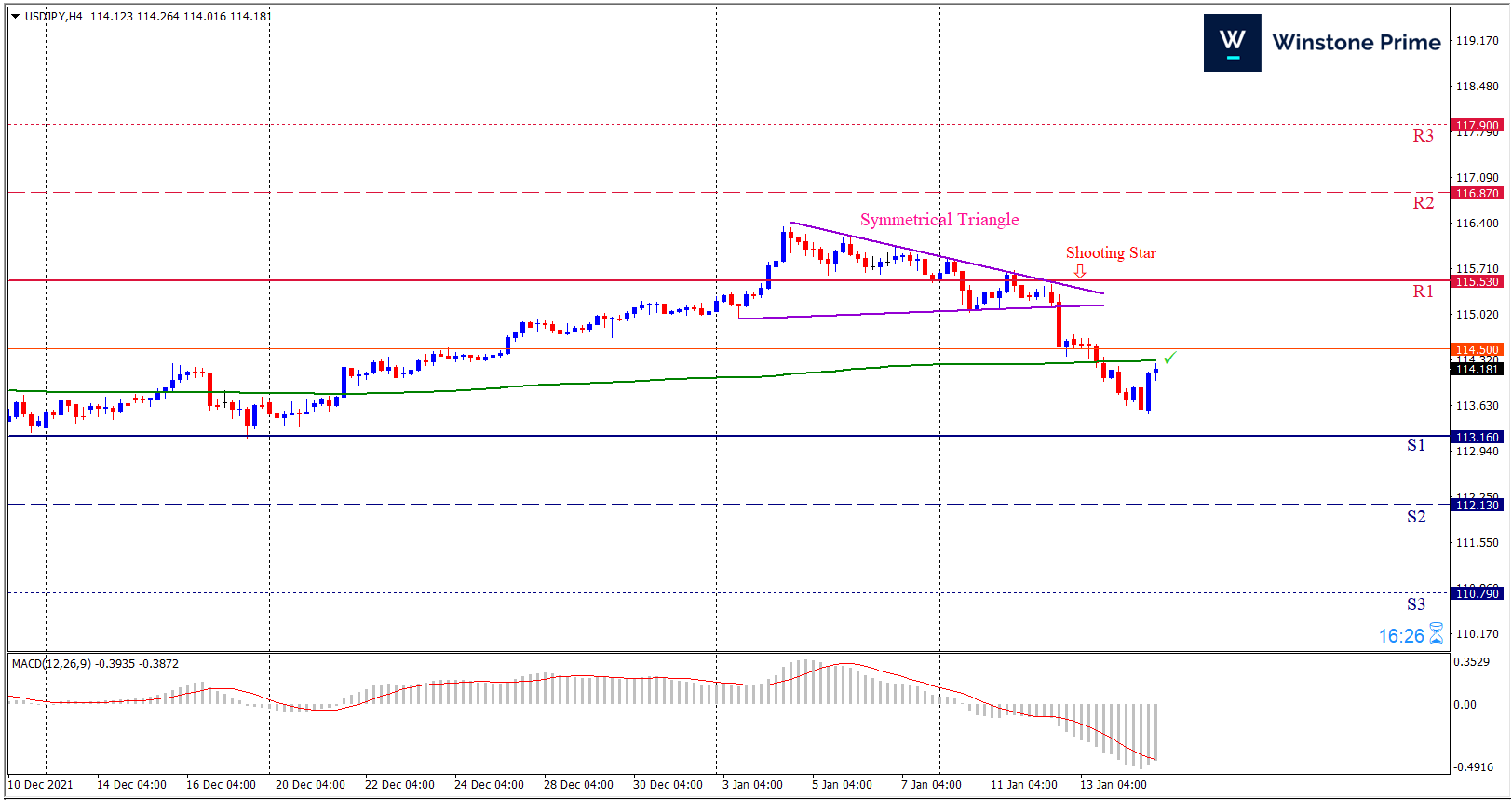

Last week’s high was 0.43% lower than the previous week. Maintaining high at 115.85 and low at 113.48 showed a movement of 237 pips.

In the upcoming week we expect USD/JPY to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. Should 113.16 proves to be unreliable support then the pair may fall further to 112.13 and 110.79 respectively whereas a solid breakout above 115.53 will open a clear path upward to 116.87 and then will further raise up to 117.90. In H4 chart, Formation of symmetrical triangle breakout downside indicates reversal of the trend creating prospects of a bearish trend Along with a shooting star formation braces our expectation.

| Preference |

| Sell: 114.18 target at 112.14 and stop loss at 115.58 |

| Alternate Scenario |

| Buy: 115.58 target at 117.89 and stop loss at 114.18 |