Fundamental view:

The US dollar edged higher against the Japanese yen during the trading course of the week. The Fed- BoJ monetary policy divergence was the key catalyst in the uptrend of the quote. Hawkish comments from fed policymakers favored the US dollar. St Louis Federal Reserve President James Bullard said the bank should not rule out 75 basis point increases. Meanwhile, Fed Chair Jerome Powell gave his commentary to the rate picture on Thursday. “I would say that 50 basis points will be on the table for the May meeting.”

On the other hand, Bank of Japan (BoJ) Governor Haruhiko Kuroda while speaking at the Columbia University Business School in New York on Friday had a more accommodative policy tone. “ The Bank should persistently continue with the current aggressive monetary easing toward achieving the price stability target of 2 percent in a stable manner,” he said in his prepared remarks.

In this week, Building Permits on 19th April and Japan Adjusted Trade Balance on 20th April boosted downtrend whereas Japan Tertiary Industry Activity Index monthly report and EIA Crude Oil Stocks Change on 20th April and Fed Powell speech on 21st April boosted uptrend for the pair.

The major economic events deciding the movement of the pair in the next week are Japan Unemployment Rate at Apr 25, US Core Durable Goods Orders monthly report, US CB Consumer Confidence Index at Apr 26, Japan Retail Sales monthly report Apr 27, BoJ Interest Rate Decision, US GDP quarterly report, US Initial Jobless Claims at Apr 28, US Employment Cost Index quarterly report and Michigan Consumer Sentiment at Apr 29.

USD/JPY Weekly outlook:

Technical View:

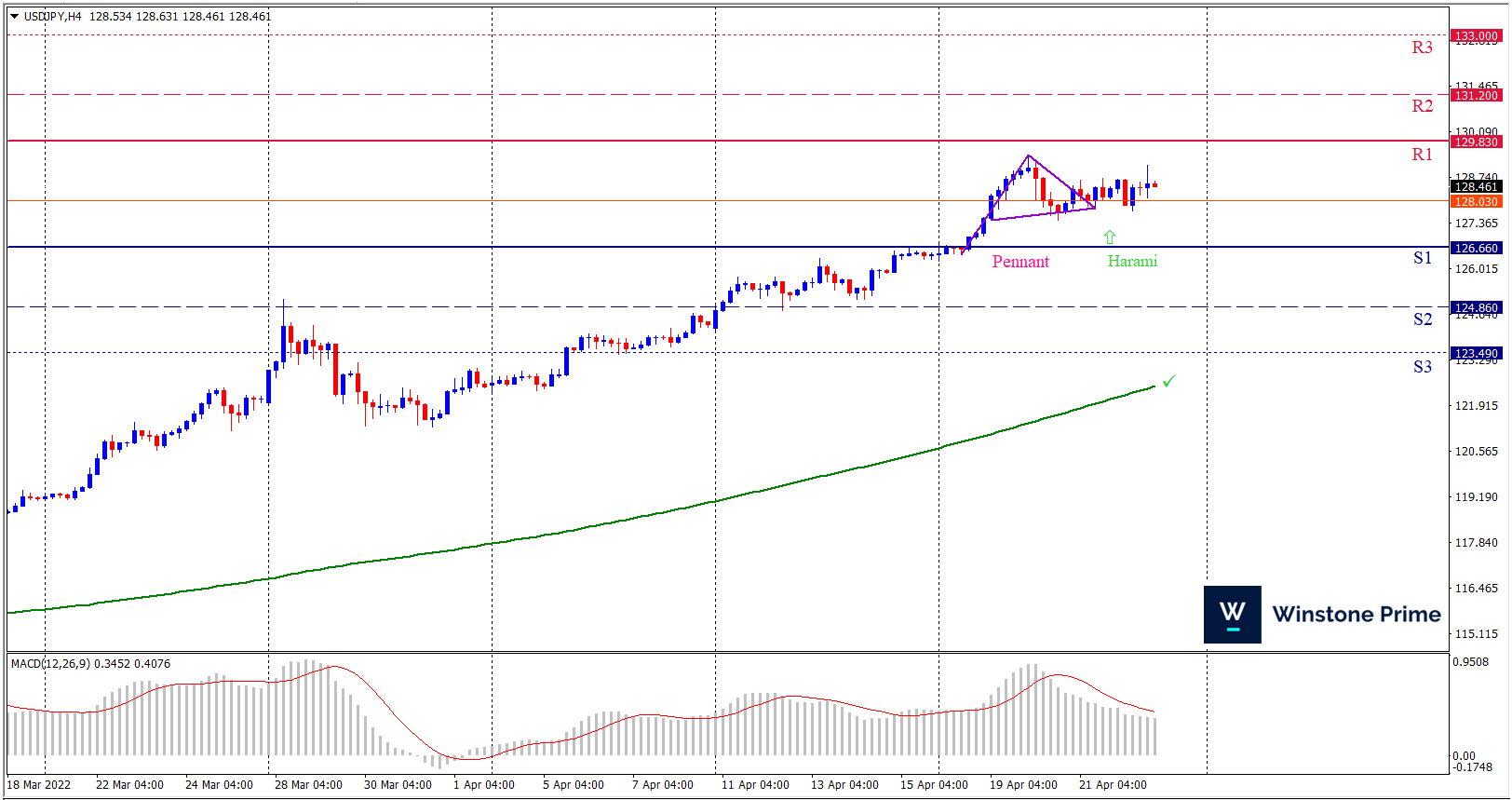

Last week’s high was 2.16% higher than the previous week. Maintaining high at 129.40 and low at 126.23 showed a movement of 317 pips.

In the upcoming week we expect USD/JPY to show a bullish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 129.83 may open a clean path towards 131.20 and may take a way up to 133.00. Should 126.66 prove to be unreliable support, the USDJPY may sink downwards 124.86 and 123.49 respectively. In H4 chart, Formation of bullish pennant pattern indicates continuation of the trend creating prospects of a bullish trend Along with a bullish harami formation braces our expectation.

| Preference |

| Buy: 128.46 target at 131.19 and stop loss at 126.61 |

| Alternate Scenario |

| Sell: 126.61 target at 123.59 and stop loss at 128.46 |