Fundamental view:

The US dollar initially fell but later in the week turned around and showed strength against the yen. The US dollar was supported by the Fed Chair Jerome Powell’s surprisingly aggressive prognosis on the taper and by the bank’s own forecast for a fed funds rate hike next year. China Evergrande crisis has also extended a helping hand in the uptrend of USD/JPY. On the other hand, the Bank of Japan (BOJ), which also met on Wednesday renewed its base rate at -0.1%. Meanwhile the contest for the head of the ruling Liberal Democratic Party (LDP) seems likely to be won by 58-year old Taro Kono, current vaccination minister and former holder of the defense and foreign affairs portfolios. Mr Kono is fluent in English and has lived and worked in the United States and Singapore.

US Current Account on 21st Sep and Japan Markit Services PMI on 24th Sep created downtrend whereas US Chicago Fed National Activity Index on 23rd Sep and US New Home Sales on 24th uptrend for the pair.

The major economic events deciding the movement of the pair in the next week are BoJ Monetary Policy Meeting Minutes, US Core Durable Goods Orders monthly report at Sep 27, US CB Consumer Confidence Index at Sep 28, Japan Retail Sales monthly report, Fed Chair Powell Speech at Sep 29, BoJ Governor Kuroda Speech, US GDP quarterly report, US Initial Jobless Claims at Sep 30 and US ISM Manufacturing PMI at Oct 01.

USD/JPY Weekly outlook:

Technical View:

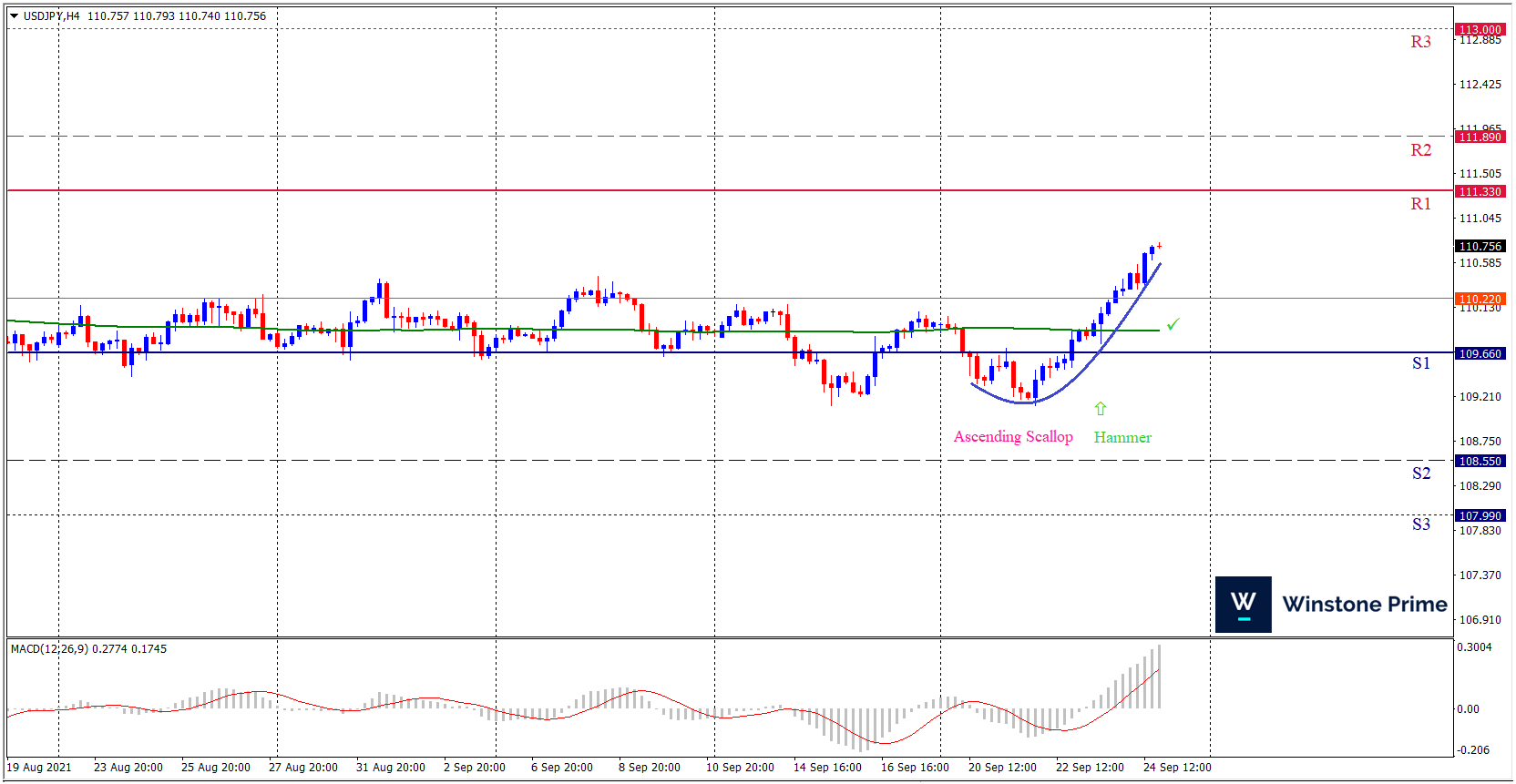

Last week’s high was 0.58% higher than the previous week. Maintaining high at 110.79 and low at 109.12 showed a movement of 167 pips.

In the upcoming week we expect USD/JPY to show a bullish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 111.33 may open a clean path towards 111.89 and may take a way up to 113.00. Should 109.66 prove to be unreliable support, the USDJPY may sink downwards 108.55 and 107.99 respectively. In H4 chart, Formation of ascending scallop pattern indicates reversal of the trend creating prospects of a bullish trend Along with a hammer formation braces our expectation.

| Preference |

| Buy: 110.75 target at 111.88 and stop loss at 110.17 |

| Alternate Scenario |

| Sell: 110.17 target at 108.76 and stop loss at 110.75 |