Fundamental view:

US Dollar edged higher against the Japanese yen during the trading course of the week. The geopolitical tension is the major catalyst in driving the pair, meanwhile hawkish Fed policymakers also favored the USD bulls. The maket came under strong risk off mood on Thursday due to Russia invasion on Ukraine, launching a massive military attack. According to US intelligence, the main goal is to depose Ukrainian President Volodymyr Zelenskyy and impose a leader favorable to the Russian regime. Moscow’s military attack took over Chernobyl and reached the capital on Friday when Russia expressed willingness to send a delegation and discuss the possibility of Ukraine becoming neutral. This somewhat eased the Market However, Ukrainian developments are the determinant factors for global markets.

Japanese economic data was mixed. Tokyo CPI in February was a bit stronger than forecast, though the core index was weaker. The Hawkish comment from Atlanta Fed President and FOMC member Raphael Bostic and Richmond Fed President, as well as an FOMC member, Thomas Barkin underpinned the bullish move of the US dollar Even though Cleveland Fed President Loretta Mester said that she doesn’t think raising interest rates by 50 bps in March is compelling. Meanwhile, Market is waiting to taking clues from BOE speech next week.

In this week, Japan Markit Manufacturing PMI on 21st February and US Core Durable Goods Orders monthly report on 25th February created bullish outlook whereas US CB Consumer Confidence Index on 22nd February and Tokyo CPI yearly report on 25th February created bearish outlook for the pair.

The major economic events deciding the movement of the pair in the next week are Japan Markit Manufacturing PMI, US ISM Manufacturing PMI at Mar 01, US ADP Nonfarm Employment Change, Fed Chair Powell Testimony at Mar 02, Japan Unemployment Rate, Initial Jobless Claims, US ISM Non-Manufacturing PMI at Mar 03 and US Nonfarm Payrolls at Mar 04.

USD/JPY Weekly outlook:

Technical View:

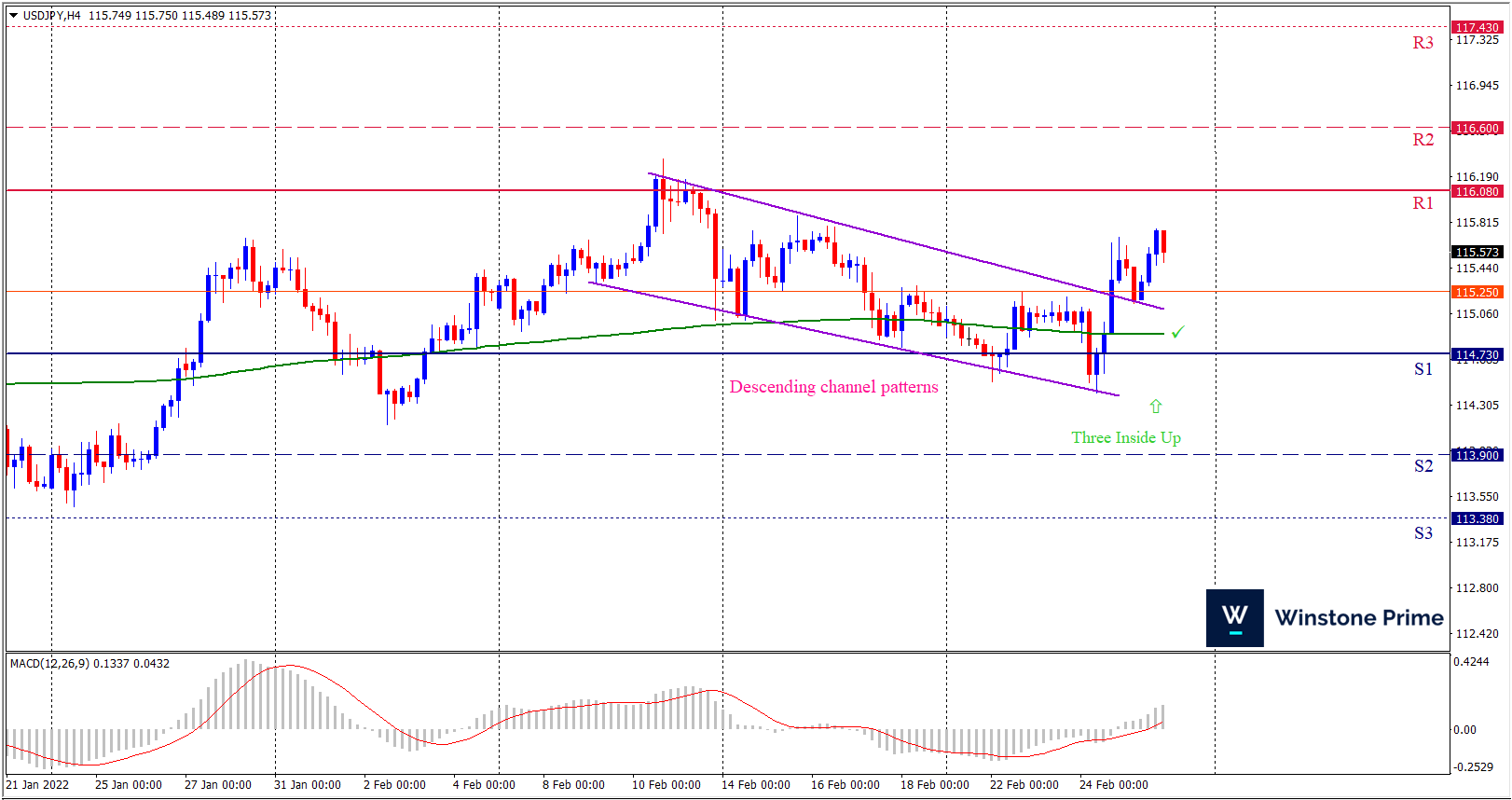

Last week’s high was 0.09% lower than the previous week. Maintaining high at 115.76 and low at 114.41 showed a movement of 135 pips.

In the upcoming week we expect USD/JPY to show a bullish trend. The currency pair is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 116.08 may open a clean path towards 116.60 and may take a way up to 117.43. Should 114.73 prove to be unreliable support, the USDJPY may sink downwards 113.90 and 113.38 respectively. In H4 chart, Formation of descending channel pattern breakout upside indicates reversal of the trend creating prospects of a bullish trend Along with a three inside up pattern formation braces our expectation.

| Preference |

| Buy: 115.52 target at 116.59 and stop loss at 114.68 |

| Alternate Scenario |

| Sell: 114.68 target at 113.69 and stop loss at 115.52 |