Fundamental view:

US dollar raised in the beginning of the week and reached its peak 115.52 on Wednesday since January 2017, the reason behind this move can be related to US inflation and Consumer spending data. But the outbreak of new coronavirus variant led to the risk aversion sentiment in the market , Along with that, better than forecast Tokyo inflation pulled the USD/JPY down. The Fed has initiated the withdrawal from its monthly $120 billion bond purchases at its November 3 meeting. A reduction of $15 billion is scheduled for November and December, with continuing subtractions expected until the program is eliminated in June. The reappointment of Jerome Powell as Federal Reserve Chair also favored the dollar On the other hand, the emergence of the South African variant led to risk aversion market sentiment.

US GDP quarterly report on 24th November and BoJ Corporate Services Price Index yearly report on 25th November framed bullish trend Whereas US Markit Services PMI on 23rd November and Tokyo CPI yearly on 26th November report framed bearish trend for the pair.

The major economic events deciding the movement of the pair in the next week are BoJ Governor Kuroda Speech, Fed Chair Powell Speech at Nov 29, US CB Consumer Confidence Index at Nov 30, Japan Markit Manufacturing PMI, US ADP Nonfarm Employment Change, ISM Manufacturing PMI, EIA Crude Oil Stocks Change at Dec 01 and Nonfarm Payrolls at Dec 03.

USD/JPY Weekly outlook:

Technical View:

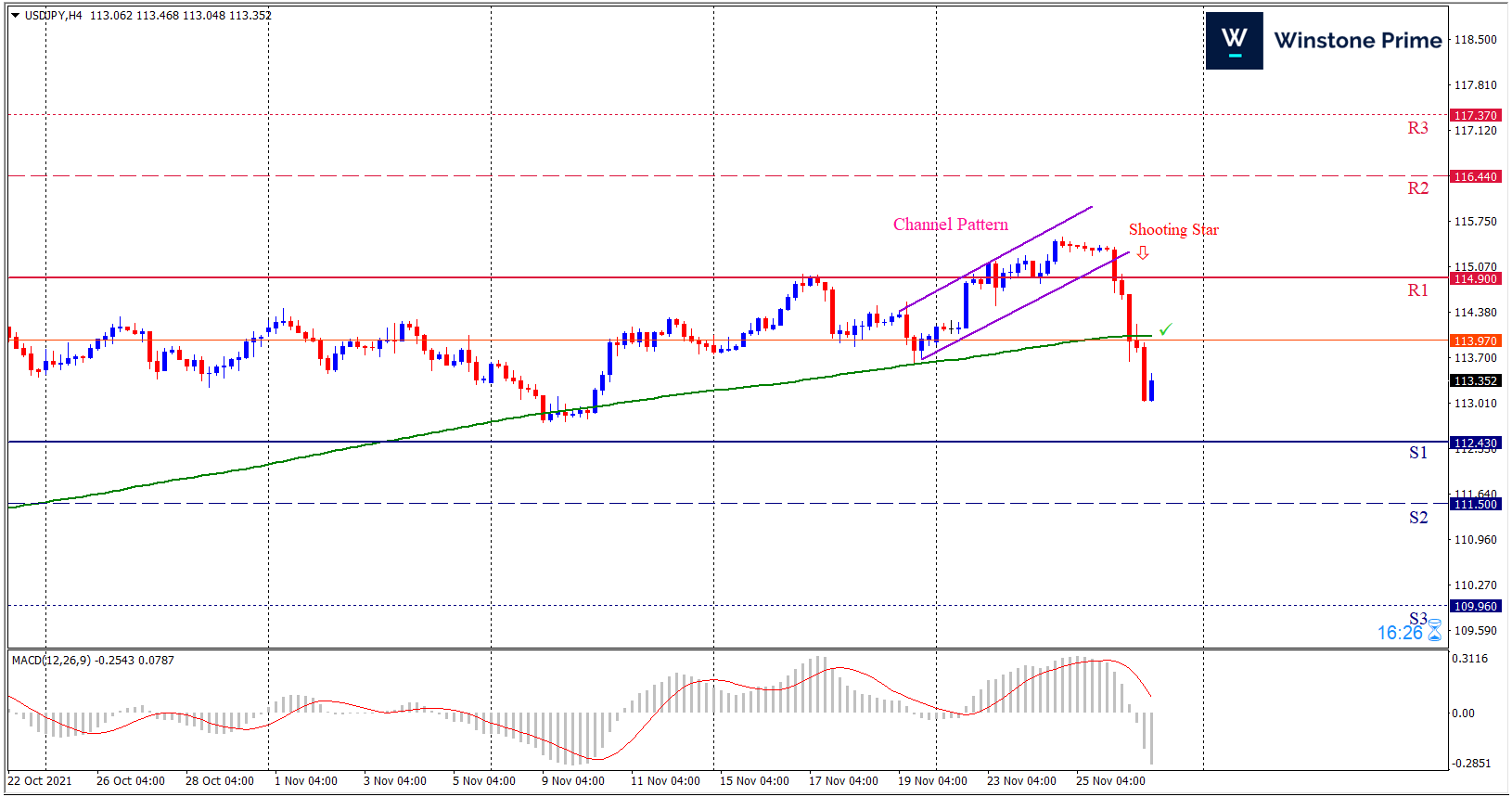

Last week’s high was 0.48% higher than the previous week. Maintaining high at 115.52 and low at 113.05 showed a movement of 247 pips.

In the upcoming week we expect USD/JPY to show a bearish trend. The currency pair is trading below the 200 Simple Moving Average and the MACD trades to the downside. A firm breakout below 112.43 may make a fall of 111.50 and then further fall of 109.96. Should 114.90 prove to be unreliable resistance, the USDJPY may raise upwards to 116.44 and 117.37 respectively. In H4 chart, Formation of channel pattern breakout indicates reversal of the trend creating prospects of a bearish trend Along with a shooting star formation braces our expectation.

| Preference |

| Sell: 113.35 target at 111.51 and stop loss at 114.04 |

| Alternate Scenario |

| Buy: 114.04 target at 116.41 and stop loss at 113.35 |