Fundamental view:

The yellow metal traded up against the US dollar during the trading course of the week. Despite the dollar strength, gold managed to hold its ground on safe haven flows in the risk averse market sentiment. The Fed unveiled the monetary policy this week. FOMC Minutes were far more aggressive than anticipated. US policymakers “generally agreed” on reducing the balance sheet by $95 billion a month, which will likely begin in May. A maximum of $60 billion in Treasuries and $35 billion in mortgage-backed securities would be allowed to roll off per month. At the same time, the document hinted at upcoming 50 bps rate hikes, instead of the average 25 bps as hiked in March.

The impact of Ukraine uncertainty favored the precious metal- Gold. European Commission President Ursula von der Leyen announced a ban on Russian coal imports, roughly worth around €4 billion a year, on Tuesday. Additionally, the US and the UK decided to disallow new investments in Russia and block all transactions with several major Russian banks.

The major economic events deciding the movement of the pair in the next week are Fed Governor Bowman Speech at Apr 11, Federal Budget Balance at Apr 12, EIA Crude Oil Stocks Change at Apr 13, Retail Sales monthly report, Initial Jobless Claims, Michigan Consumer Sentiment at Apr 14 and Fed Industrial Production yearly report at Apr 15 for US.

XAU/USD Weekly outlook:

Technical View:

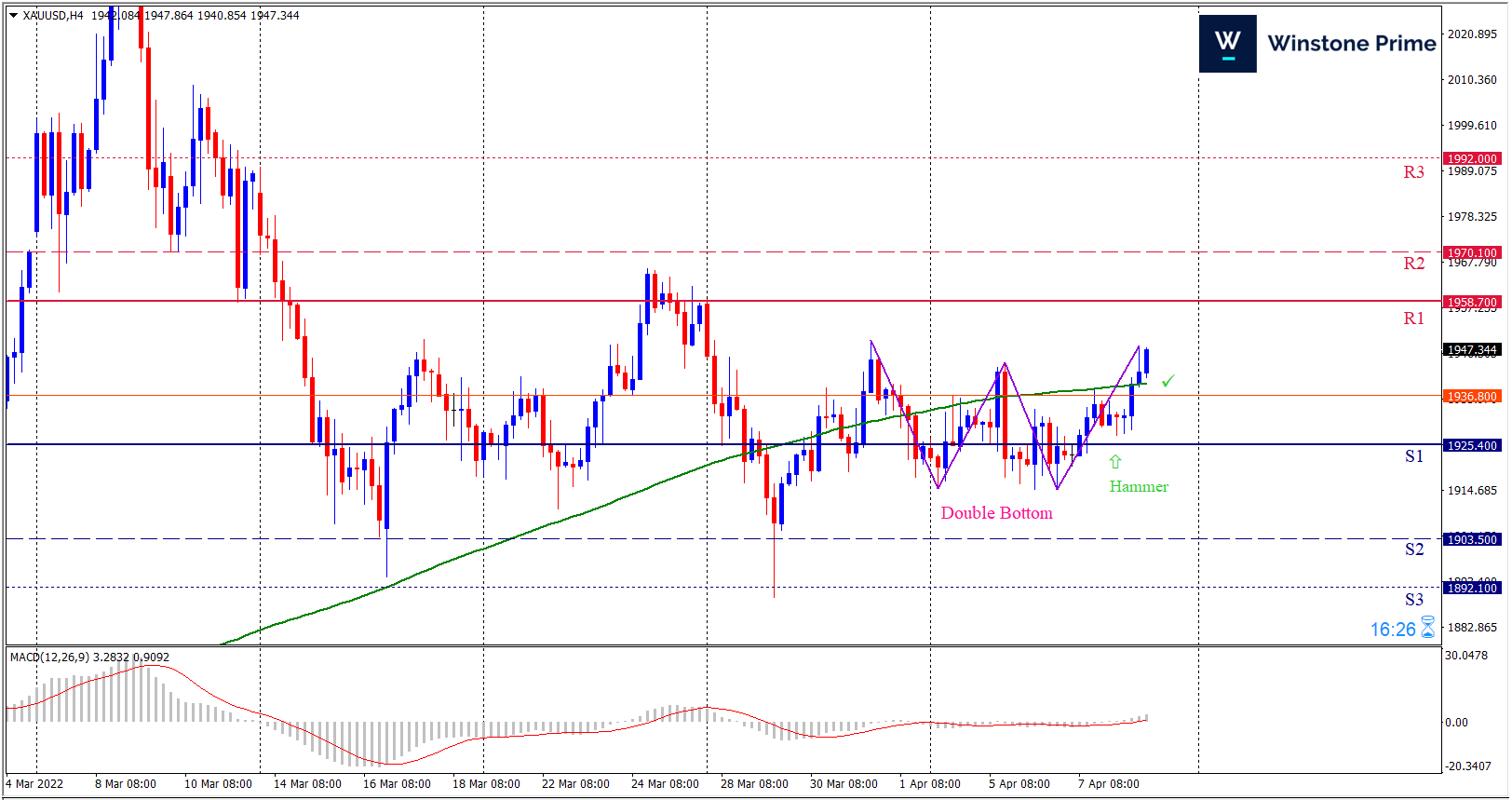

Last week’s high was 0.56% lower than the previous week. Maintaining high at 1948.2 and low at 1914.9 showed a movement of 333 pips.

In the upcoming week we expect XAU/USD to show a bullish trend. The Instrument is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 1958.7 may open a clean path towards 1970.1 and may take a way up to 1992.0. Should 1925.4 prove to be unreliable support, the XAUUSD may sink downwards 1903.5 and 1892.1 respectively. In H4 chart double bottom pattern favors prospects of a bullish trend. Also to be noted Hammer formation exerts the expectation of uptrend for the pair.

| Preference |

| Buy: 1947.3 target at 1980.5 and stop loss at 1920.7 |

| Alternate Scenario |

| Sell: 1920.7 target at 1893.4 and stop loss at 1947.3 |