Fundamental view:

The yellow metal traded high against the US dollar with skyrocketing on the last day of the trading week. Gold was trading to the upside during the initial 3 days of the week taking advantage of weak dollar but on Thursday it tumbled due to the US dollar gaining strength with stronger than expected inflation data. However, Gold bounced back on Friday due to geopolitical developments concerning the Ukraine – Russia conflicts. The US reported the January Consumer Price Index, which soared to 7.5% YoY against the forecast of 7.2%,and the jump was the highest level since February 1982. This led to the market expectation that the Fed might adopt a more aggressive policy stance to combat high inflation and market priced for a 50 bps rate hike in March.

On the geopolitical front, According to a PBS NewsHour reporter, “the US believes that Russian President Vladimir Putin has decided to invade Ukraine and already communicated those plans to the Russian military. Two Biden administration officials said they expect the invasion to begin as soon as next week.” This created the cautious market sentiment which favored the safe haven precious metal.

The major economic events deciding the movements of the pair in the next week are NY Fed Empire State Manufacturing Index at Feb 15, Retail Sales monthly report, EIA Crude Oil Stocks Change, FOMC Minutes at Feb 16, Initial Jobless Claims, Philadelphia Fed Manufacturing Index at Feb 17, Existing Home Sales at Feb 18 for US.

XAU/USD Weekly outlook:

Technical View:

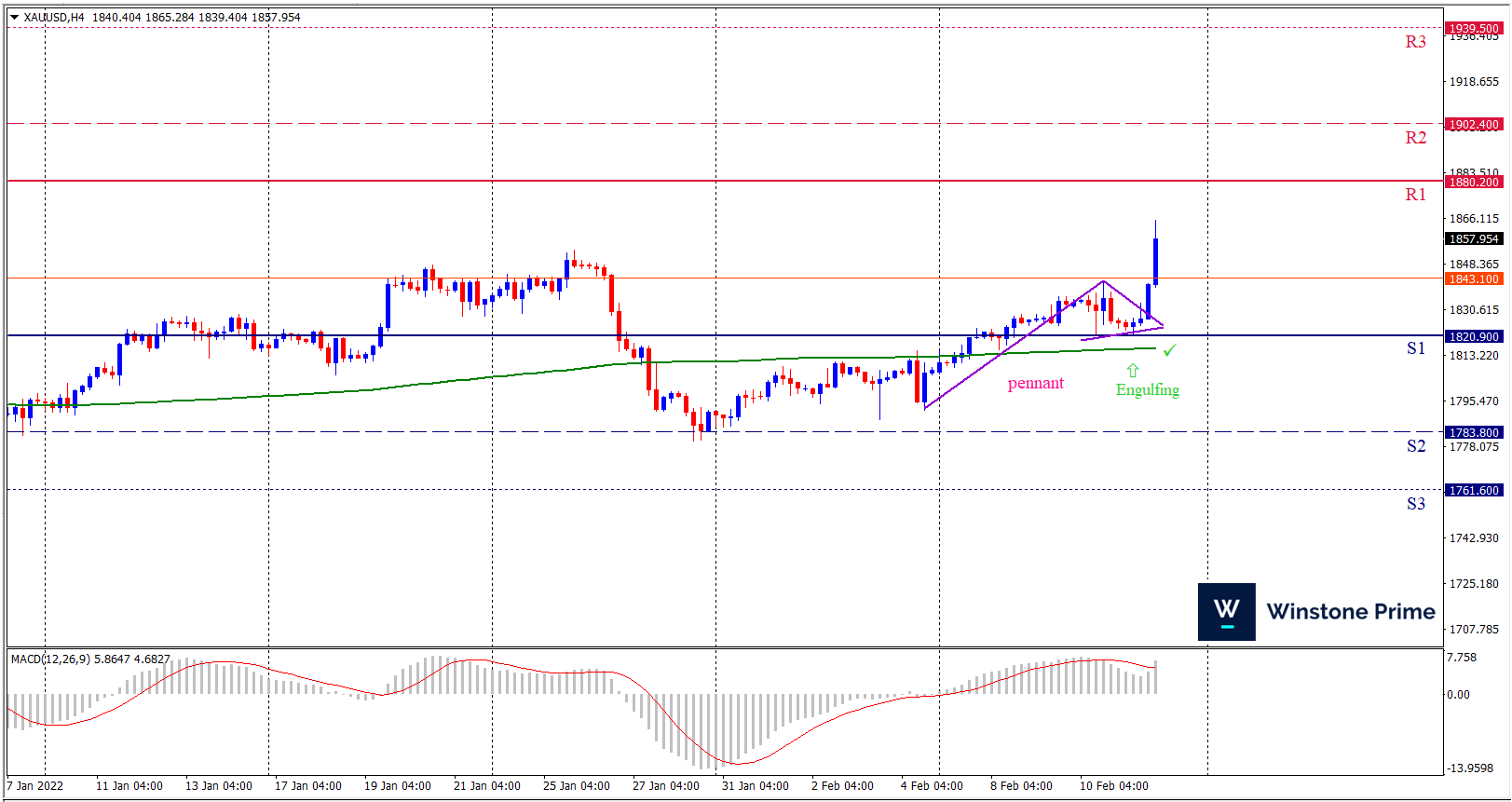

Last week’s high was 2.70% higher than the previous week. Maintaining high at 1865.3 and low at 1806.0 showed a movement of 593 pips.

In the upcoming week we expect XAU/USD to show a bullish trend. The Instrument is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 1880.2 may open a clean path towards 1902.4 and may take a way up to 1939.5. Should 1820.9 prove to be unreliable support, the XAUUSD may sink downwards 1783.8 and 1761.6 respectively. In H4 chart pennant pattern breakout favors prospects of a bullish trend. Also to be noted Bullish engulfing formation exerts the expectation of uptrend for the pair.

| Preference |

| Buy: 1857.5 target at 1909.9 and stop loss at 1815.7 |

| Alternate Scenario |

| Sell: 1815.7 target at 1762.6 and stop loss at 1857.5 |