Fundamental view:

Gold initially gained against the US dollar but fell at the end of the week. The data published by the US Bureau of Labor Statistics revealed that the Core Consumer Price Index (CPI) had stayed unchanged on a yearly basis at 4% in September and the reading provided a boost to risk sentiment. Moreover, upbeat third-quarter earnings from big US financial institutions made it difficult for the safe-haven greenback to find demand, this helped the yellow metal.

The data from the US showed on Thursday that the annual Producer Price Index (PPI) rose to 8.6% in September from 8.3% in August. Further, the US Department of Labor made an announcement that there were 293,000 initial claims for unemployment benefits in the US during the week ending October 9. The key U.S. data point Friday is the monthly retail sales report for September, which came in at up 0.7% versus the consensus forecast of down 0.2% from August. The August report was also revised up, to a 0.9% gain from the original figure of up 0.7%. This benefited the US dollar and trouble the XAU/USD.

The major economic events deciding the movement of the pair in the next week are Fed Industrial Production yearly report at Oct 18, EIA Crude Oil Stocks Change at Oct 20, Philadelphia Fed Manufacturing Index, Initial Jobless Claims at Oct 21 and Markit Manufacturing PMI at Oct 22 for US.

XAU/USD Weekly outlook:

Technical View:

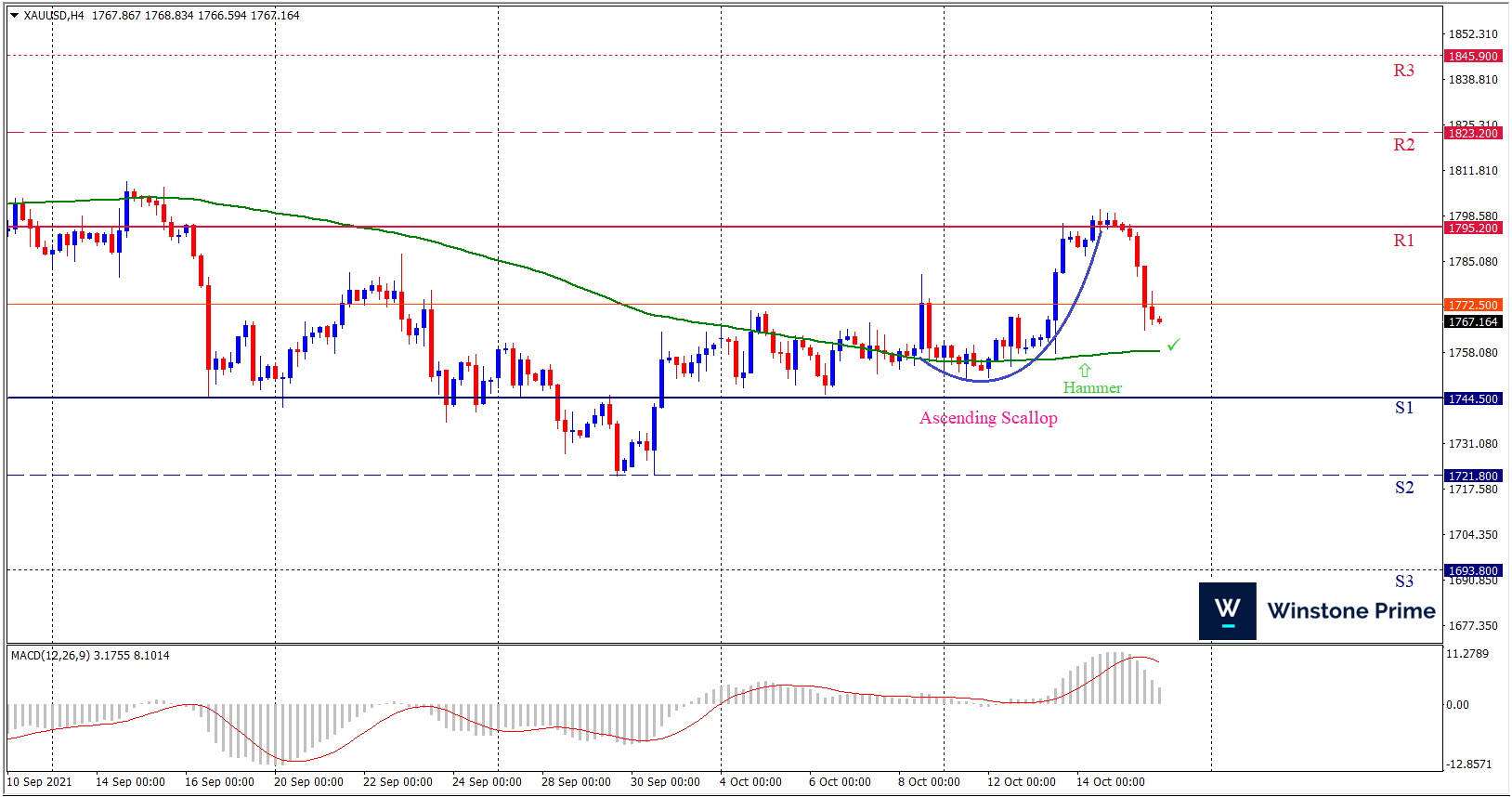

Last week’s high was 1.07% higher than the previous week. Maintaining high at 1800.5 and low at 1749.8 showed a movement of 507 pips.

In the upcoming week we expect XAU/USD to show a bullish trend. The Instrument is trading above the 100 Simple Moving Average and the MACD trades to the upside. A solid breakout above 1795.2 may open a way towards 1823.2 and then lead a way to 1845.9. Should 1744.5 prove to be unreliable support, the XAUUSD may sink downwards to 1721.8 and 1693.8 respectively. In H4 chart ascending scallop pattern frames prospects of a bullish trend. Also to be noted hammer formation exerts the expectation of uptrend for the pair.

| Preference |

| Buy: 1772.9 target at 1822.2 and stop loss at 1739.5 |

| Alternate Scenario |

| Sell: 1739.5 target at 1694.8 and stop loss at 1772.9 |