Fundamental view:

The yellow metal rallied initially but later fell badly during the trading course of the week. With the news that the Federal Reserve could opt out to delay the reduction in asset purchases led the dollar to weaken against its rivals. But the risk-averse market environment helped the US Dollar Index (DXY) limit its downside and posed a problem for the yellow metal to maintain its bullish momentum.

As per recent news, a strategist told that “If the U.S. economic data continues to surprise on the upside, gold could be in store for another selloff.” We see yields starting to pick up, and the U.S. dollar is strong. This puts pressure on gold” In the upcoming week, Federal Reserve will announce monetary policy decisions alongside the updated Summary of Projections following the FOMC’s two-day meeting. In case Powell unveils that the Fed will start reducing asset purchases before the end of the year, the USD is likely to gather strength and will led to the fall of the yellow metal.

The major economic events deciding the movement of the pair in the next week are Building Permits at Sep 21, EIA Crude Oil Stocks Change, Fed Interest Rate Decision at Sep 22, Initial Jobless Claims at Sep 23 and Fed Chair Powell Speech at Sep 24 for US.

XAU/USD Weekly outlook:

Technical View:

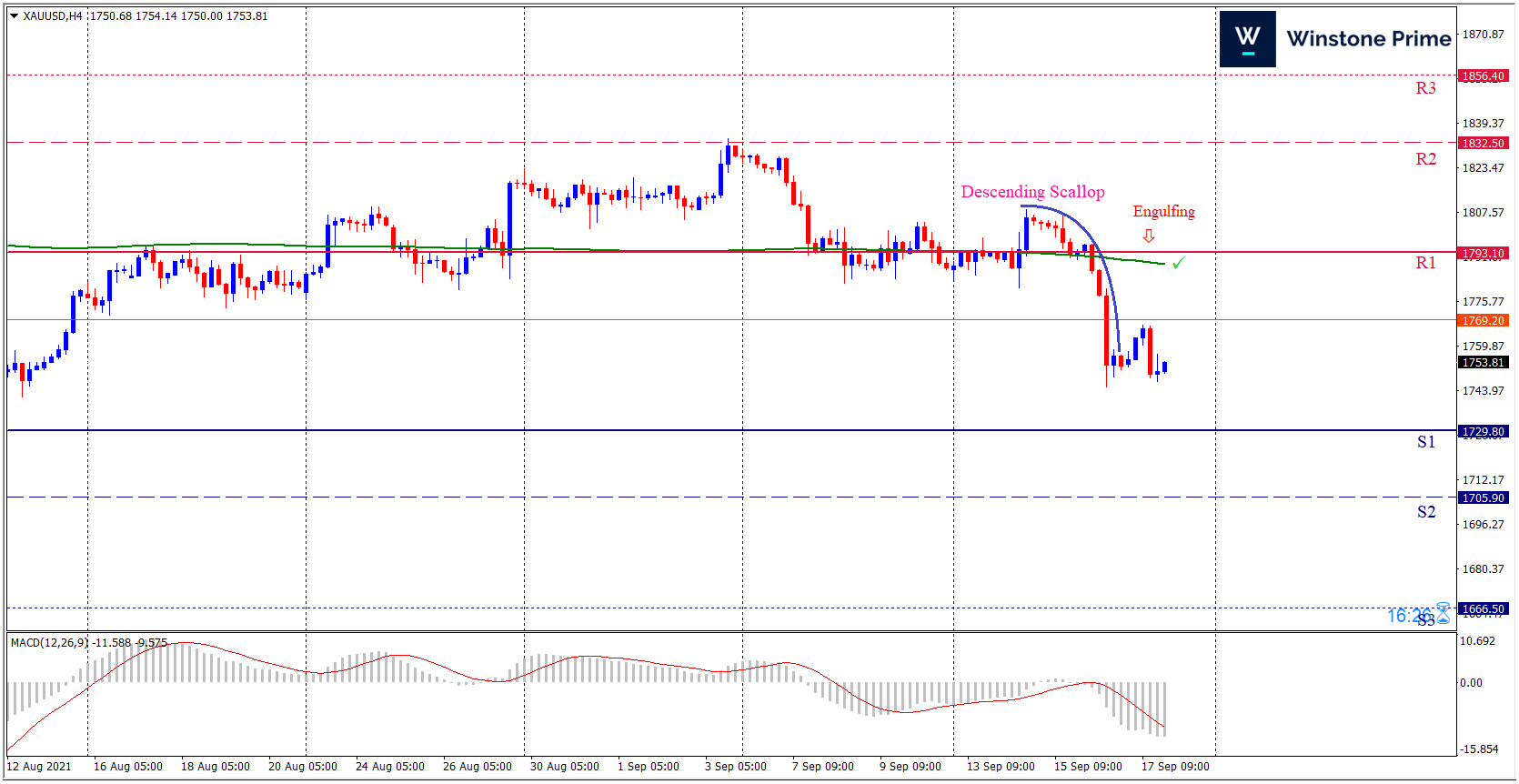

Last week’s high was 1.18% lower than the previous week. Maintaining high at 1808.5 and low at 1745.2 showed a movement of 633 pips.

In the upcoming week we expect XAU/USD to show a bearish trend. The Instrument is trading below the 200 Simple Moving Average and the MACD trades to the downside. A solid breakout below 1729.8 may open a clean path towards 1705.9 and may take a way down to 1666.5. Should 1793.1 prove to be unreliable resistance, the XAUUSD may raise upwards 1832.5 and 1856.4 respectively. In H4 chart descending scallop pattern favors prospects of a bearish trend. Also to be noted bearish engulfing formation exerts the expectation of downtrend for the pair.

| Preference |

| Sell: 1753.6 target at 1706.9 and stop loss at 1777.2 |

| Alternate Scenario |

| Buy: 1777.2 target at 1825.4 and stop loss at 1753.6 |