Fundamental view:

The Yellow metal fell against the greenback in this week. Without any high-tier macroeconomic data releases and fundamental developments, risk perception remained the primary market driver earlier in the week. The sharp decline which was seen in Wall Street’s main indexes on Monday and Tuesday allowed the greenback to find demand. In the last week US Department of Labor reported there were 419,000 initial claims for unemployment benefits in the US during the week ending July 17. This was worse than the market expectation of 350,000 but was largely ignored by traders.

In the upcoming week, a major news is the release of monetary statement. FOMC will announce its Interest Rate Decision and publish the Monetary Policy Statement. While delivering his prepared remarks at a congressional hearing earlier in the month, FOMC Chairman Jerome Powell said the job market was still a ways off from progress needed to begin the bond-buying taper.

The major economic events deciding the movement of the pair in the next week are Core Durable Goods Orders monthly report, CB Consumer Confidence Index at July 27, EIA Crude Oil Stocks Change, Fed Interest Rate Decision at July 28, GDP quarterly report, Initial Jobless Claims at July 29 and Michigan Consumer Sentiment at July 30 for US.

XAU/USD Weekly outlook:

Technical View:

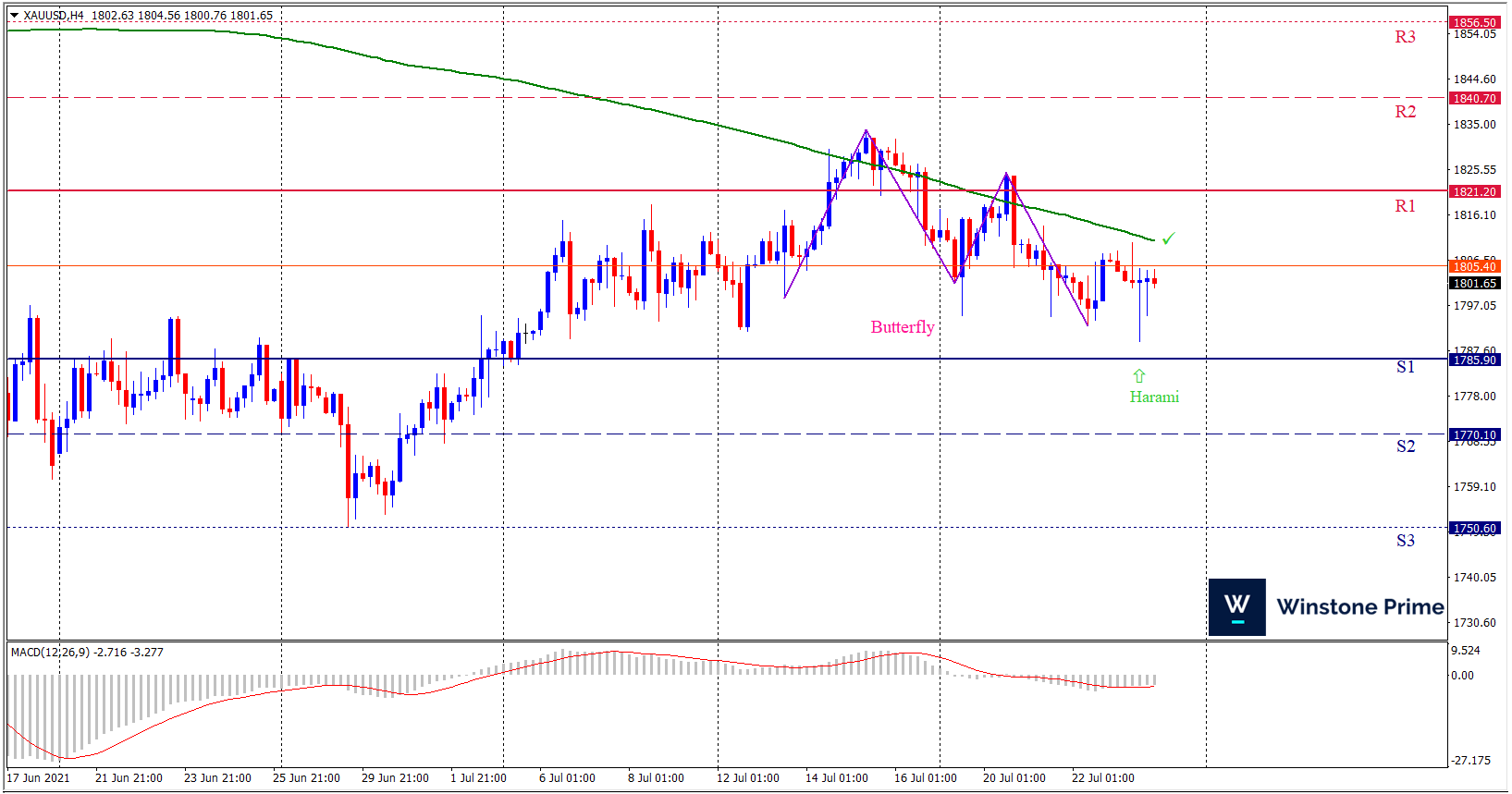

Last week’s high was 0.49% lower than the previous week. Maintaining high at 1824.9 and low at 1789.6 showed a movement of 353 pips.

In the upcoming week we expect XAU/USD to show a bullish trend. The Instrument is trading below the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 1821.2 may open a clean path towards 1840.7 and may take a way up to 1856.5. Should 1785.9 prove to be unreliable support, the XAUUSD may sink downwards 1770.1 and 1750.6 respectively. In H4 chart bullish butterfly pattern favors prospects of a bullish trend. Also to be noted Bullish harami formation exerts the expectation of uptrend for the pair.

| Preference |

| Buy: 1802.4 target at 1835.7 and stop loss at 1780.6 |

| Alternate Scenario |

| Sell: 1780.6 target at 1751.3 and stop loss at 1802.4 |