Fundamental view:

The yellow metal initially fell against the greenback but later rose for the last two consecutive days. The bullion traders portrayed risk-on mood due to the positive updates over the Omicron covid variant and the US stimulus, while also ignoring firmer US Treasury yield in the end of the week. Elsewhere, Central banks are tightening monetary policy; along with the U.S. Federal Reserve adopting a hawkish tone at its latest policy meeting favors the market mood. Moreover, US President Joe Biden’s Build Back Better (BBB) stimulus plan also favors the market sentiment. Metal focus reported that Gold demand in India recovered sharply in the second half of 2021 as jewelry purchases and investment in physical metal surged following a downturn caused by COVID-19 restrictions and uncertainty. Looking first at gold, Metals Focus said that the strong recovery has been led by festive and wedding buying.

On the other hand, the continuous, rapid spread of the omicron COVID-19 variant remains a concern. China’s biggest-ever lockdown in Xi’an and the doubts of White House over the availability of Pfizer’s pill, joined by French rejection to Merck’s drug, pose a challenge in the market sentiment.

Amidst risk sentiment remaining firm and the US dollar is on the back foot gave the yellow metal to breath above water in the end of the week. Gold may trade high amidst a thin trading session ahead of the new year eve.

The major economic events deciding the movement of the pair in the next week are S&P/CS HPI Composite-20 yearly report at Dec 28, EIA Crude Oil Stocks Change, Pending Home Sales monthly report at Dec 29, Initial Jobless Claims and MNI Chicago Business Barometer at Dec 30 for US.

XAU/USD Weekly outlook:

Technical View:

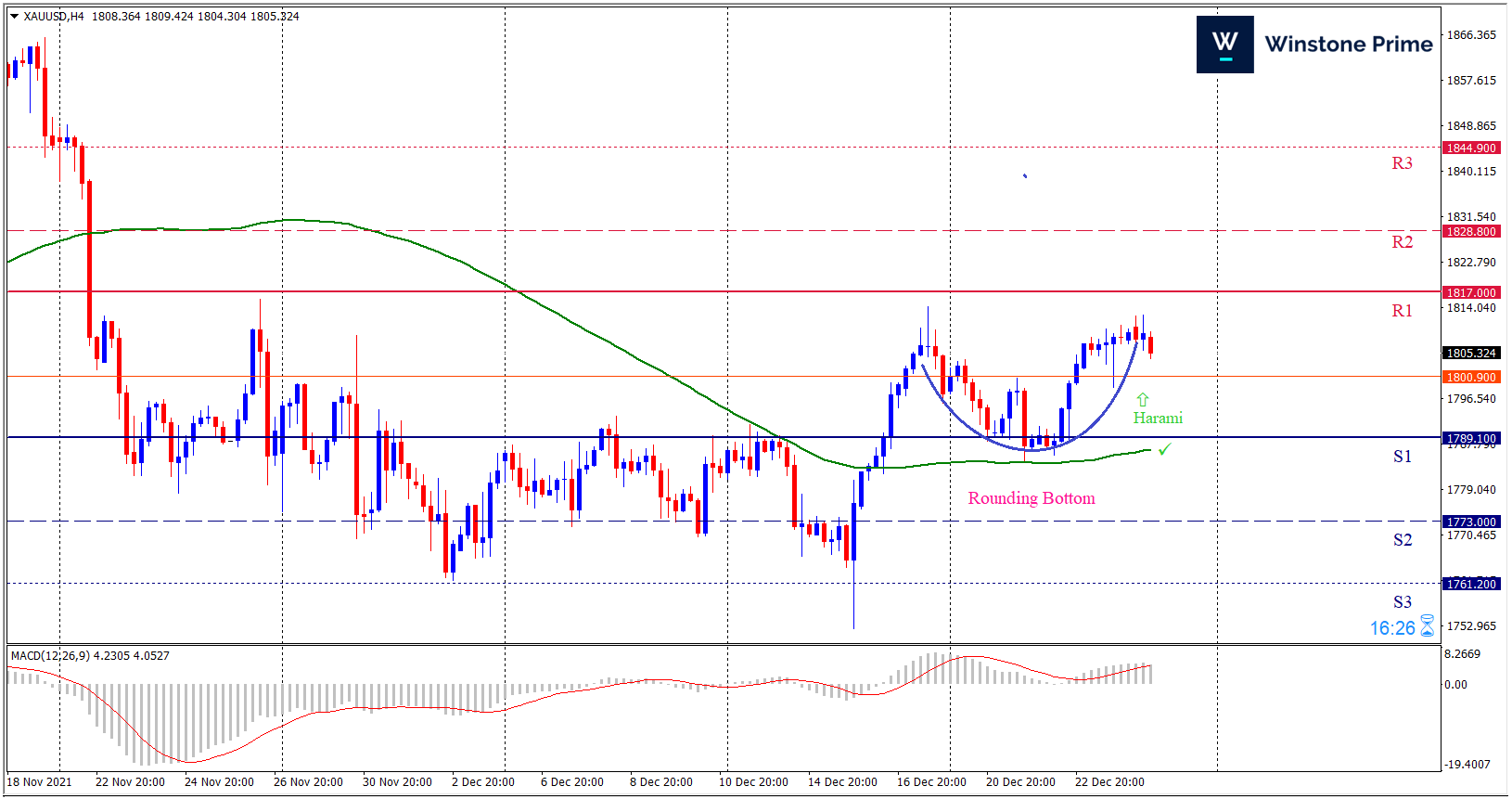

Last week’s high was 0.09% higher than the previous week. Maintaining high at 1812.6 and low at 1784.7 showed a movement of 279 pips.

In the upcoming week we expect XAU/USD to show a bullish trend. The Instrument is trading above the 100 Simple Moving Average and the MACD trades to the upside. A solid breakout above 1817.0 may open a clean path towards 1828.8 and may take a way up to 1844.9. Should 1789.1 prove to be unreliable support, the XAUUSD may sink downwards 1773.0 and 1761.2 respectively. In H4 chart rounding bottom pattern favors prospects of a bullish trend. Also to be noted Bullish harami formation exerts the expectation of uptrend for the pair.

| Preference |

| Buy: 1805.3 target at 1830.8 and stop loss at 1784.7 |

| Alternate Scenario |

| Sell: 1784.7 target at 1762.2 and stop loss at 1805.3 |