Fundamental view:

Gold traded back and forth against the US dollar during the course of the week. The headlines on the Russia – Ukraine crisis made the gold to fluctuate. It reached to its highest level since September 2020 at $1,974 on Thursday, and later it declined below $1,900 in the early American session on Friday and closed with snapping a three-week winning streak. Initially, the hope of diplomatic solution to the Russia-Ukraine crisis made it difficult for gold to build on the previous week gain and it started to gain by Wednesday when Russia started piling up troops near the Ukrainian border and it soared on Thursday , When Russia announced that it had launched a “special military operation” against Ukraine and Russian President Vladimir Putin said that the aim was to demilitarize Ukraine.

Whereas on Friday, reports of Russian forces moving toward the Ukrainian capital of Kyiv with the intention of overthrowing the government forced markets to a risk off mood. The yellow metal spent the first half of the day in a relatively tight range above $1,900. In the early American session, Later reports of Russia willing to send a delegation to Minsk for talks with Ukraine revived optimism for a diplomatic end to war. XAU/USD came under bearish pressure on this development. Ukraine developments will be the major catalyst in the market next week.

The major economic events deciding the movement of the pair in the next week are ISM Manufacturing PMI at Mar 01, ADP Nonfarm Employment Change, Fed Chair Powell Testimony, EIA Crude Oil Stocks Change at Mar 02, Initial Jobless Claims, ISM Non-Manufacturing PMI at Mar 03 and Nonfarm Payrolls at Mar 04 for US.

XAU/USD Weekly outlook:

Technical View:

Last week’s high was 3.64% higher than the previous week. Maintaining high at 1974.3 and low at 1877.7 showed a movement of 966 pips.

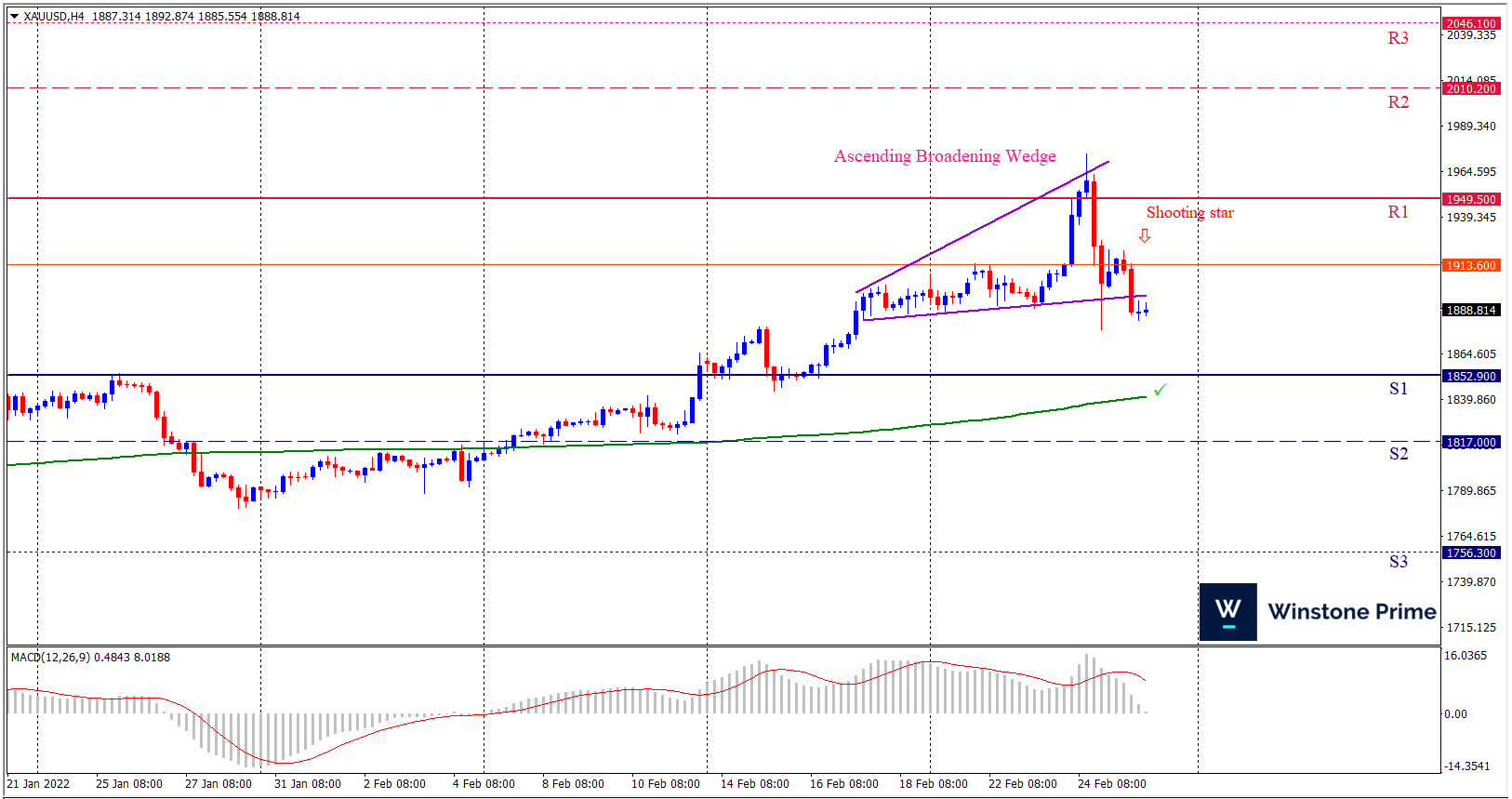

In the upcoming week we expect XAU/USD to show a bearish trend. The Instrument is trading above the 200 Simple Moving Average and the MACD trades to the downside. Should 1852.9 proves to be unreliable support then the pair may fall further to 1817.0 and 1756.3 respectively whereas a solid breakout above 1949.5 will open a clear path upward to 2010.2 and then will further raise up to 2046.1. In H4 chart Ascending Broadening Wedge breakout downside favors prospects of a bearish trend. Also to be noted shooting star formation exerts the expectation of downtrend for the pair.

| Preference |

| Sell: 1888.8 target at 1825.5 and stop loss at 1920.5 |

| Alternate Scenario |

| Buy: 1920.5 target at 1974.8 and stop loss at 1888.8 |