Fundamental view:

The yellow metal traded high against the greenback during the trading course of the week. FOMC member’s hawkish stance favored the greenback during the first half of the week, and gold traded within a tight range uring first half of the week. FOMC Chairman Jerome Powell said that there is an obvious need to “move expeditiously” to a more neutral level or even restrictive levels to tame inflation. He also added “If we need to raise the Fed funds rate by more than 25 basis points (bps) at a meeting of meetings, we will do so.” On the same line, Cleveland Fed President Loretta Mester argued that a 50 basis points rate increase should not be off the table. Similarly, “the data will tell us if 50 bps is the right recipe” San Francisco Fed President Mary Daly noted. “I have everything on the table.”

On Thursday, The US and its allies announced that they will block the Russian central bank’s financial transactions that involve gold to make it difficult for the country to finance the war and bypass sanctions. Experts are with the opinion that Central Bank of Russia has more than $100 billion worth of gold in its holdings, which makes up roughly 20% of the bank’s reserves. This development favored the yellow metal.

The major economic events deciding the movement of the pair in the next week are Goods Trade Balance at Mar 28, CB Consumer Confidence Index at Mar 29, ADP Nonfarm Employment Change, GDP quarterly report, EIA Crude Oil Stocks Change at Mar 30, Initial Jobless Claims at Mar 31 and Nonfarm Payrolls at Apr 01 for US.

XAU/USD Weekly outlook:

Technical View:

Last week’s high was 1.21% lower than the previous week. Maintaining high at 1966.2 and low at 1910.4 showed a movement of 558 pips.

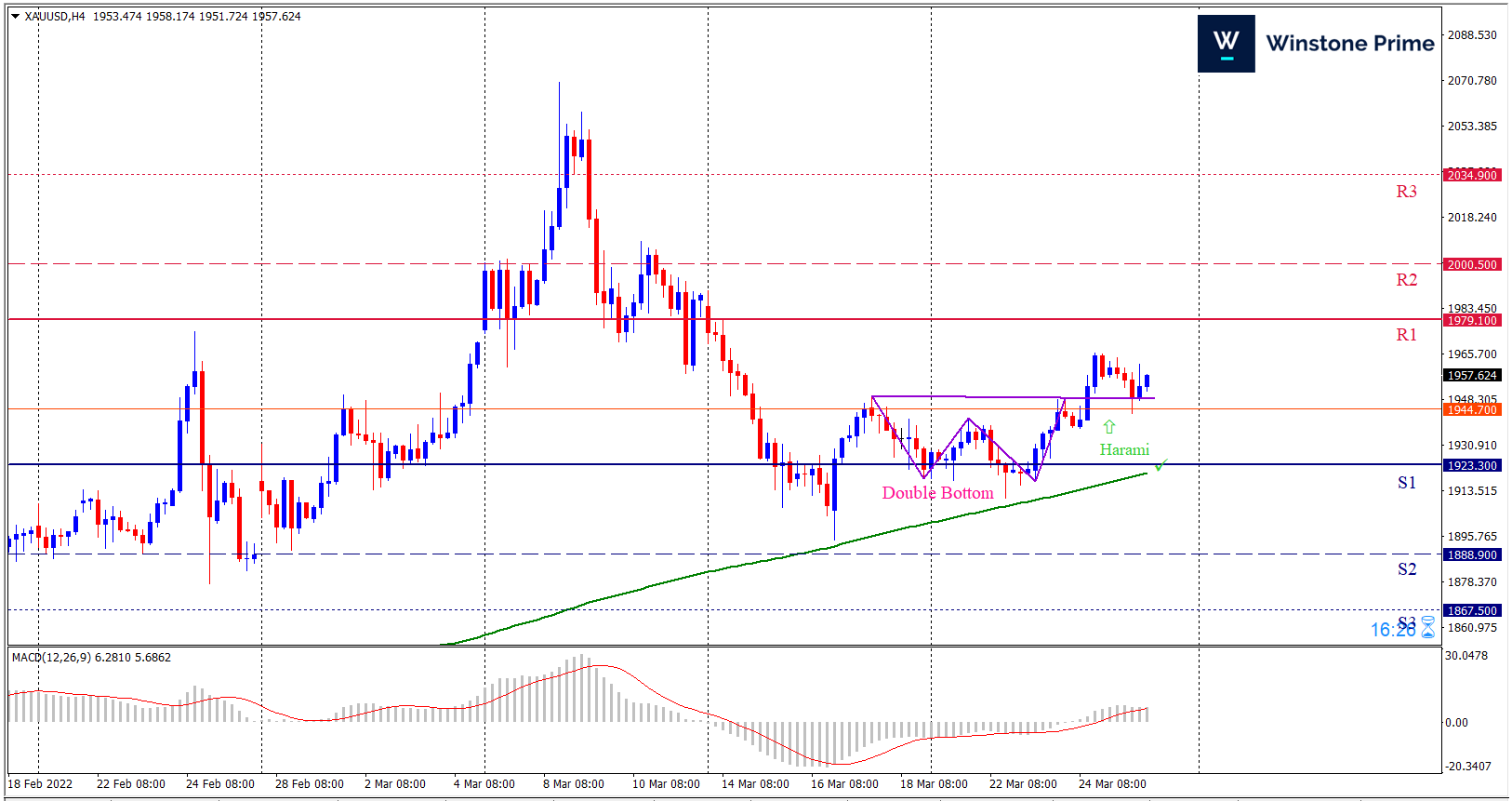

In the upcoming week we expect XAU/USD to show a bullish trend. The Instrument is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 1979.1 may open a clean path towards 2000.5 and may take a way up to 2034.9. Should 1923.3 prove to be unreliable support, the XAUUSD may sink downwards 1888.9 and 1867.5 respectively. In H4 chart double bottom pattern breakout favors prospects of a bullish trend. Also to be noted Bullish harami formation exerts the expectation of uptrend for the pair.

| Preference |

| Buy: 1957.6 target at 1999.5 and stop loss at 1920.3 |

| Alternate Scenario |

| Sell: 1920.3 target at 1868.7 and stop loss at 1957.6 |