Fundamental view:

The yellow metal stayed on the front foot jumping to its highest level in more than a month at $1,820 against the greenback this week. The improved market mood favored the yellow metal. The U.S. recorded its highest number of Covid cases this week, ever as the Omicron variant rages. However, the market is looking Covid as “serious but manageable” given the vaccines and other drugs to battle the virus.

According to George Milling-Stanley who is precious metals analyst, gold should be on pace to resume its long-term bullish uptrend in the new year. George Milling-Stanley, chief gold strategist at State Street Global Advisors, said that his base case scenario, with a 50% probability, is for gold prices to trade between $1,800 and $2,000 an ounce in 2022. He added that he sees a 30% chance of gold prices pushing above $2,000 to a new record high.

He said “We see an 80% chance of gold prices staying in the current range to moving higher next year,” “Even with the Federal Reserve looking to tighten interest rates next year, we think gold has a pretty good chance of moving higher.”

On the other hand, According to commodity analysts at J.P. Morgan Global Research, The gold market will not be able to withstand the Federal Reserve’s plan to tighten its monetary policy in 2022.

In its recently published 2022 outlook report, the bank expects gold prices to fall to pre-pandemic levels by the end of next year. The outlook comes as the Federal Reserve plans to end its monthly bond purchases by March and looks to raise interest rates three times. Currently, markets are starting to price in the first rate hike in May. What 2022 has yellow metal to offer is yet to be seen.

The major economic events deciding the movement of the pair in the next week are OPEC Meeting, ISM Manufacturing PMI at Jan 04, ADP Nonfarm Employment Change, EIA Crude Oil Stocks Change, FOMC Minutes at Jan 05, Initial Jobless Claims, ISM Non-Manufacturing PMI at Jan 06 and Nonfarm Payrolls at Jan 07 for US.

XAU/USD Weekly outlook:

Technical View:

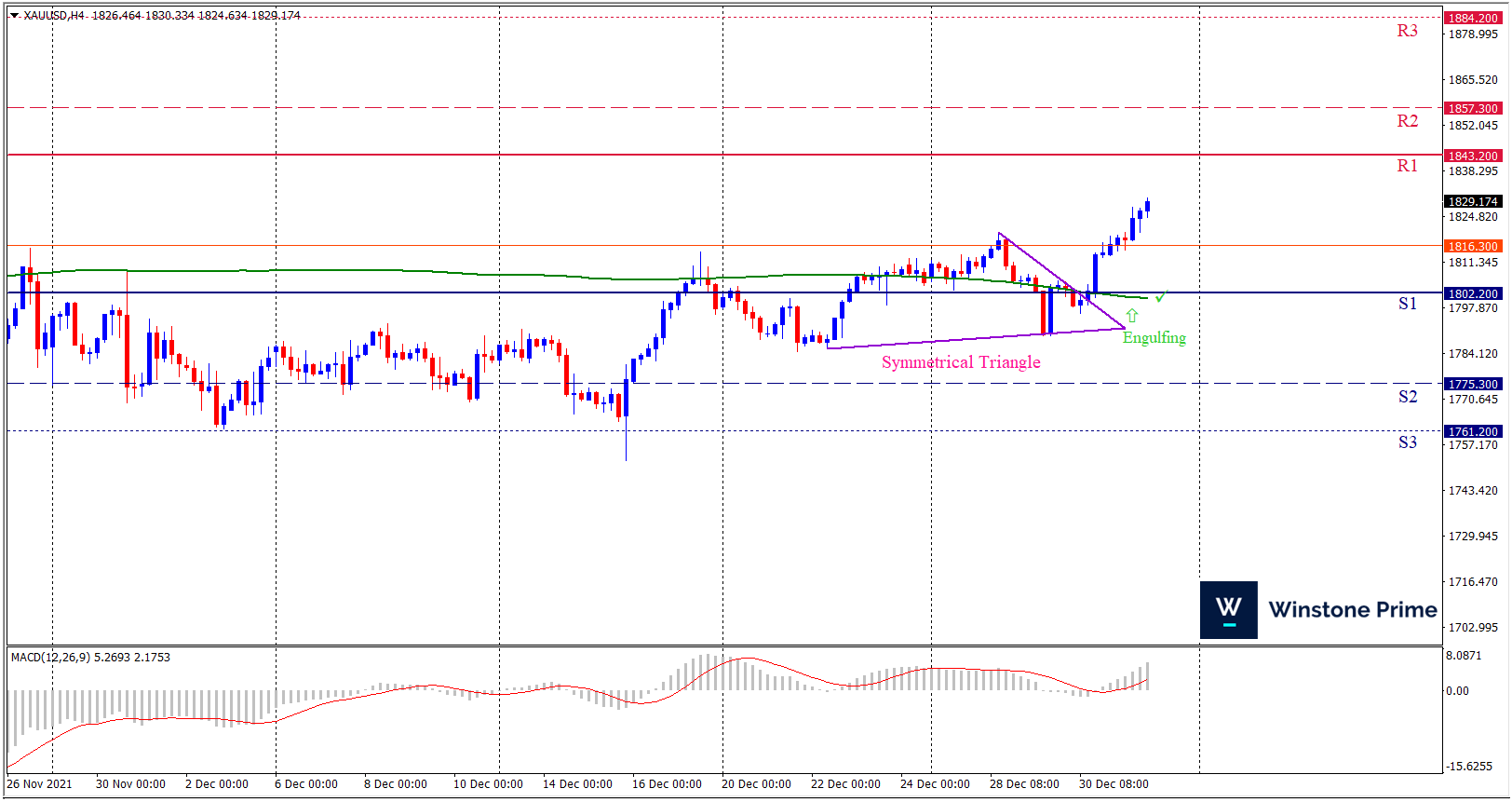

Last week’s high was 0.97% higher than the previous week. Maintaining high at 1830.3 and low at 1789.3 showed a movement of 410 pips.

In the upcoming week we expect XAU/USD to show a bullish trend. The Instrument is trading above the 200 Simple Moving Average and the MACD trades to the upside. A solid breakout above 1843.2 may open a clean path towards 1857.3 and may take a way up to 1884.2. Should 1802.2 prove to be unreliable support, the XAUUSD may sink downwards 1775.3 and 1761.2 respectively. In H4 chart symmetrical triangle breakout favors prospects of a bullish trend. Also to be noted Bullish engulfing formation exerts the expectation of uptrend for the pair.

| Preference |

| Buy: 1829.2 target at 1867.6 and stop loss at 1800.5 |

| Alternate Scenario |

| Sell: 1800.5 target at 1762.7 and stop loss at 1829.2 |